The Southern California Hotel Investment Summit

Thursday, December 13, 2012

SLS Hotel – Beverly Hills

CLICK HERE FOR MORE INFORMATION!

AGENDA

7:30-8:30 AM: Coffee & Networking

8:30-9:15 AM: Special Keynote: Sam Nazarian

9:15-10 AM: Panel: How Deals are Getting Done

10-10:45 AM: Panel: Development and 2013 Outlook

10:45-11:30 AM: Post-Game Networking

|

|

|

Keynote by entrepreneur, visionary, & developer |

| Sam Nazarian |

Founder, CEO and Chairman

sbe |

|

| |

|

|

|

|

|

| |

|

| |

Maki Bara

|

| President & Co-Founder |

| The Chartres Lodging Group |

|

|

|

|

| |

Bob Sonnenblick

|

| Chairman |

| Sonnenblick Development LLC |

|

|

|

|

| |

Warren de Haan

|

| Chief Originations Officer |

| Starwood Property Trust |

|

|

| |

|

|

|

|

|

| |

|

| |

|

|

|

|

|

| |

|

| |

Chris Dobbins

|

| VP of Development |

| Hyatt |

|

|

|

|

| |

Vernon Chi

|

| SVP, Hospitality Finance Group |

| Wells Fargo |

|

|

|

|

| |

Dan Lesser

|

| CEO |

| LW Hospitality |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

KEYNOTE MODERATOR

|

|

| |

|

| |

Tom Naughton

|

| Chief Investment Officer |

| Clearview Hotel Capital |

|

|

|

|

| |

Alison Cumberland

|

| VP |

| Marriott International |

|

|

|

|

| |

Michael Scheinberg

|

| Partner |

| Pircher, Nichols & Meeks |

|

|

| |

|

|

|

|

|

| |

|

| |

|

|

|

MODERATOR |

|

| |

|

|

|

|

|

|

|

|

|

| |

Rich Brand

|

| Partner |

| Arent Fox |

|

|

| |

|

|

|

|

|

|

| More Speakers to be Announced! |

|

HONCHO HOEDOWN

Sonnenblick Development prez Bob Sonnenblick and STR Global’s Jan Freitag insisted our reporter Amanda Metcalf to get in a pic. Check out the blue and orange color coordination this trio’s got going. Bob tells us there’s never been a better time to buy land for resorts, adding that feasibility experts say new construction has been at minimal levels for three full years.

[Click for full article]

Los Angeles Construction & Development Summit

source: http://www.bisnow.com

Julie@bisnow.com

Developers have a lot on their minds these days, and we’re not talking about who’s going to win this season of So You Think You Can Dance. Our second panel at Bisnow’s LA Construction & Development Summit this week gave us an earful.

In the last go-round, Sonnenblick Development’s Bob Sonnenblick built 1M SF of office space in the LA area. This go-round, he’s in the hotel development business and noted that the prebooking for six months out is up a good 7% to 8%. Bob said he’s been involved in four arranged marriages in LA, but not to worry—he meant that on four projects he’s had the architect working for him on a base design, then switched to a pure design-build contract where he has a guaranteed maximum price with the general contractor, and the architect is working for the GC.

In the last go-round, Sonnenblick Development’s Bob Sonnenblick built 1M SF of office space in the LA area. This go-round, he’s in the hotel development business and noted that the prebooking for six months out is up a good 7% to 8%. Bob said he’s been involved in four arranged marriages in LA, but not to worry—he meant that on four projects he’s had the architect working for him on a base design, then switched to a pure design-build contract where he has a guaranteed maximum price with the general contractor, and the architect is working for the GC.

Bob noted that in all of his design-build contracts, he throws 100% of the risk onto the shoulders of his general contractors; there’s surely bonding, as well. “I can go to sleep for two years and that thing still gets developed the way I want it to.” (Though there are other reasons why he shouldn’t sleep for two years: Chief among them, who wins the Super Bowl.) Among the barriers, he cited entitlement process issues such as traffic and neighborhood groups. For Kristina, the challenge is carpetbaggers with no vested interest in a neighborhood who come in and make claims. The huge specific plan USC is trying to entitle is a case in point: A group asked for $250M in exchange for non-opposition. (Support would cost extra.)

Bob noted that in all of his design-build contracts, he throws 100% of the risk onto the shoulders of his general contractors; there’s surely bonding, as well. “I can go to sleep for two years and that thing still gets developed the way I want it to.” (Though there are other reasons why he shouldn’t sleep for two years: Chief among them, who wins the Super Bowl.) Among the barriers, he cited entitlement process issues such as traffic and neighborhood groups. For Kristina, the challenge is carpetbaggers with no vested interest in a neighborhood who come in and make claims. The huge specific plan USC is trying to entitle is a case in point: A group asked for $250M in exchange for non-opposition. (Support would cost extra.)

Dining with us in his work clothes at BOA Steakhouse in Santa Monica Wednesday evening, Bob Sonnenblick demonstrates why he left New York 30 years ago to come west. Well, in addition to the fact that the renowned company founded by his grandfather in 1910, which financed much of New York’s skyline made him head of West Coast operations where he helped finance much of downtown LA’s booming skyline in the ’80s. Nearly 25 years ago he went on to start Sonnenblick Development, which has not only developed numerous federal and commercial office buildings, but also resorts in places like Park City, Palm Springs, and Palm Beach, where he can also get fresh air and additional use of his colorful shirts.

Dining with us in his work clothes at BOA Steakhouse in Santa Monica Wednesday evening, Bob Sonnenblick demonstrates why he left New York 30 years ago to come west. Well, in addition to the fact that the renowned company founded by his grandfather in 1910, which financed much of New York’s skyline made him head of West Coast operations where he helped finance much of downtown LA’s booming skyline in the ’80s. Nearly 25 years ago he went on to start Sonnenblick Development, which has not only developed numerous federal and commercial office buildings, but also resorts in places like Park City, Palm Springs, and Palm Beach, where he can also get fresh air and additional use of his colorful shirts.

Bisnow: Keeping the coffee hot, and the panel discussions too.

Bob Sonnenblick Bob Sonnenblick

Principal

Sonnenblick, LLC Robert completed over $1.5B of commercial real estate transactions on the west coast. Among the most notable include: Beaudry Center, LA ($197M), The Ritz-Carlton Hotel, Pasadena ($97M), One Waterfront Plaza, Honolulu, HI ($100M) and the LA World Trade Center ($55M). He was also an original development partner of the $90M Loews Santa Monica Beach Hotel, which sold for $125M.

Mark D. Payne Mark D. Payne

Partner

Panattoni Development Company

Mark leads Panattoni’s operations in LA and San Diego. With 150M SF of completed projects, Panattoni ranks among the top industrial developers in the US. Prior to starting Panattoni’s LA and San Diego ops in ’09, Mark launched Panattoni Europe in ’04. Under his leadership, it grew to 120 employees, 12 offices, and a 97% leased portfolio. While there, Mark led the development of 12M SF of industrial and retail projects.

Kristina Raspe

VP, Real Estate Development and Asset Management

USC

Kristina leads all off-campus real estate development and construction projects as well as preparatory work for on-campus real estate projects exceeding 20k SF. She also oversees all campus planning activities, including the master-planning processes on both the University Park and Health Sciences campuses, and work associated with USC’s plans to develop a biomedical research park on the Health Sciences campus.

Scott Hunter

Principal, LA Office Director

HKS Architects

Under Scott’s leadership, HKS Los Angeles has over 2M SF in design and 1.6M SF in construction. Notable current projects include a new replacement hospital at Camp Pendleton, the restoration of 50 United Nations Plaza, a 40 story condo tower in San Francisco. HKS is in design and construction on three major projects with USC, has ongoing work with Kaiser and Cedars Sinai, a casino retail project in Macau, China, as well as several hotels and office projects throughout Southern California.

Andrew Millar

Project Development Manager

Hensel Phelps Construction Co.

Andrew leads District procurement functions. He is responsible for the coordination and communication of design-related activities between the architectural, engineering, estimating and operations team. He coordinates and communicates all design requirements and program modifications. Previously, he served with Clark Construction as mechanical electrical and plumbing coordinator, and Berg Electric overseeing field operations.

MODERATOR

Robert Peddicord

Senior Managing Director of Institutional Services

CBRE

Robert oversees the integrated service delivery of CBRE’s global platform to property owners and investors in LA, Orange County and the Inland Empire. He provides regional oversight for asset services, project management, investment sales, debt & equity finance and agency leasing. He previously spent more than 12 years at GE Capital/Arden where he was Executive VP of Operations and Leasing before becoming COO. He most recently was COO at Younan Properties.

**More Speakers to be Announced** |

Monday, June 25, 2012Omni Hotel Los Angeles

251 South Olive Street

Los Angeles, CA 90012

Agenda

8 AM – 9 AM Coffee & Networking

9 AM – 9:45 AM Construction, Design, & Engineering Outlook

9:45 AM – 10:30 AM Development Outlook

10:30 AM – 11 AM Post-Game Schmooze

With projects that were once on hold during the recession beginning to come back online, the state of the construction industry & future development in SoCal is at a pivotal point:

- What does it take to get a new project off the ground?

- What innovative methods keep projects moving?

- What are some of the new financing strategies?

- What impact does sustainability have on the future of development?

- How does one go about renovating existing assets?

- How is the SoCal market different than other business centers?

Join Bisnow and construction & development community leaders and advisors to gain invaluable information, insight, and (of course) schmooze time. |

Sonnenblick Development and Ritz-Carlton are actively looking at a specific block in Santa Monica to do a $150M high-rise hotel project, Bisnow learned yesterday. (It’ll be remembered fondly as the place Sonnenblick and Ritz made beautiful music together.)

Sonnenblick Development and Ritz-Carlton are actively looking at a specific block in Santa Monica to do a $150M high-rise hotel project, Bisnow learned yesterday. (It’ll be remembered fondly as the place Sonnenblick and Ritz made beautiful music together.)

Principal Bob Sonnenblick and his wife Pamela celebrated their 23rd anniversary this past weekend at the Hotel Bel-Air. He tells us the project is envisioned as a 200-room Ritz-Carlton hotel, along with about 120k SF of branded condos plus some ground-floor retail. Ever since Bob and his partners sold the Loews on Ocean Avenue a few years back, he’s been itching to get back into the Santa Monica hotel market.

The Loews Santa Monica Beach Hotel sold for a cool $125M. But that’s not all—Bob has been selected to build a pair of full-service and limited-service hotels totaling $100M at Sacramento International Airport. Slated to begin construction in mid-2013—the airport’s first new rooms in 30 years—the hotels will be attached to the airport’s new terminal.

Sonnenblick Development also has spent $100M to buy seven sites to build full-service resort hotels. Two of them are in Palm Beach, Fla., and the Bahamas. “We like the warm weather markets, and we really focus on oceanfront real estate.” Bob’s an active polo player as well as an avid skier—last month he was in Alta, Utah (above). But he’ll leave his skis at home on June 25, when Bob will be a panelist on our LA Construction & Development Summit at the Omni Hotel Los Angeles. [Register here]!

Sacramento Business Journal | April 13, 2012 | sacramentobusinessjournal.com

MELANIE TURNER | STAFF WRITER

Company to study market demand, negotiate terms with airport officials

Despite lagging demand and an oversupply of rooms in the region, the developer proposing two hotels at Sacramento International Airport is eager to start work.

The Sacramento County Board of Supervisors voted 5-0 on Wednesday to negotiate an agreement with Sonnenblick Industries LLC. Three years after plans for an airport hotel were scrapped, the Pacific Palisade company has proposed privately financing a 132-room budget hotel and a 200-room full-service hotel at no cost to the county. One reason, said company chairman Bob Sonnenblick: The airport’s former 89-room hotel, which was leveled to make room for the new Terminal B, had the highest occupancy of any hotel in Sacramento County for 40 years.

“It was kind of an old, grade B-minus hotel,”

Sonnenblick said. “Imagine what a good quality hotel would do in an even better

location within the airport and with a new $1 billion terminal to feed into it… I’m very excited about this project.”

Bob Sonnenblick

chairman,

Sonnenblick Industries LLC

The success of on-airport hotels in Sacramento will depend upon the success of the airport itself, said Alan Reay, president and founder of Atlas Hospitality Group. “That’s the big gamble there,” he said. “It’s really going to depend on the forecast for traffic at Sacramento International.”

Sonnenblick funded an initial feasibility study that indicated the airport could support two hotels with more than 20,000 square feet of meeting space.

As part of the agreement with the county, Sonnenblick will now commission a study to provide more in-depth information on market demand. Airport staff also will begin negotiations with Sonnenblick to finalize other terms and conditions, such as rent. The board will consider a more fully negotiated agreement at a later date. Linda Cutler, deputy director of commercial strategy for the airport system, said it’s standard practice for airports the size of Sacramento International or larger to offer a hotel. Sacramento draws travelers from a wide geographic area, including Napa and the Central Valley, who may take flights that leave early or land late, she said. She said there’s real value in being able to offer travelers an on-site hotel as an alternative to having to find ground transportation to get to a hotel in nearby Natomas, for example.

In addition, she said, hotel amenities, from business centers to restaurants, would generate revenue for the airport.

Sonnenblick proposes a development team that would include Gold River-based Tricorp Hearn Construction Inc. and San Francisco-based RYS Architects. The company’s proposal estimates gross revenue of $19.2 million in the first year and $30.4 million by year 10, according to a county staff report.

The proposal comes as Sacramento’s hotel market — which added space at a furious rate before being hit hard by the Great Recession – struggles to recover. In February, year-to-date hotel occupancy in Sacramento was 53.3 percent, up from 52 percent for the same two-month period a year earlier, according to figures from Atlas. Occupancy rates in 2006 exceeded 70 percent.

Airport hotels at San Francisco and Los Angeles are doing fantastic, Reay said. But the smaller Ontario International Airport – which, like Sacramento, poured big money into an expansion – has seen passenger traffic drop dramatically and is facing possible closure.

But Reay said Sacramento may be very different from Ontario, and less likely to lose business since alternative air travel is more than an hour away.

“There is no substitute for Sacramento,” he said. “I don’t think Sacramento will suffer the same fate.”

The airport, meanwhile, is working to attract new carriers – and passengers.

Just this week, the Sacramento County Board of Supervisors approved an incentive package totaling $400,000 to try to attract low-fare airline Virgin America Inc. to the airport. Airport officials have been in talks with Burlingame-based Virgin America for several months about adding service between Sacramento and Los Angeles.

MELANIE TURNER covers energy, environment,

clean technology, agriculture, transportation, media and marketing.

melanieturner@bizjournals.com | 916-558-7859

http://www.bloomberg.com/news/2012-04-11/two-new-hotels-costing-100-million-planned-for-airport.html

http://www.bloomberg.com/news/2012-04-11/two-new-hotels-costing-100-million-planned-for-airport.html

Sonnenblick Development LLC, which helped develop Loews Santa Monica Beach Hotel, will spend $100 million on two hotels at California’s Sacramento International Airport, the site’s first new lodging properties in 30 years.

The Los Angeles-based company won the contract to build the hotels, to be attached to the airport’s new Terminal B, according to Robert Sonnenblick, the company’s principal. Construction of a 225-room full-service hotel and a 150-room limited-service property will start in mid-2013, with an opening planned for the first quarter of 2015, he said.

Hotel development has been stagnant in California and across the U.S. because construction financing has been difficult to obtain, according to Sonnenblick. The Sacramento airport’s only hotel, a 150-room property from the mid-1970s, was demolished to make room for the new terminal, he said.

“An airport of this size can support several hotels but currently has none,” Sonnenblick said. “We see this as a specific opportunity that provides us with a monopoly in the foreseeable future.”

Sonnenblick’s company will begin interviewing potential hotel operators for the airport properties this month, he said. The contract to build the hotels is with Sacramento County, which is leasing the land to Sonnenblick Development.

The firm has spent $100 million over the past two years to buy seven parcels on the U.S. coasts, in locations it hasn’t disclosed, for luxury resorts.

To contact the reporter on this story: Nadja Brandt in Los Angeles at nbrandt@bloomberg.net

To contact the editor responsible for this story: Daniel Taub at dtaub@bloomberg.net

Sacramento Business Journal by Melanie Turner, Staff Writer

Date: Thursday, April 12, 2012, 6:51am PDT

The Sacramento County Board of Supervisors voted 5-0 Wednesday to move ahead on a proposal for the private development of two hotels on airport property.

Sonnenblick Industries LLC has proposed financing the development of two hotels at Sacramento International Airport , three years after plans for an airport hotel were scrapped because of the flailing economy.

Airport staff will now begin negotiations with Pacific Palisades — which will design, develop and operate the hotels — to finalize other terms and conditions, such as rent. Sonnenblick also will commission a feasibility study.

The board is expected to consider a more fully negotiated agreement at a later date.

Sacramento International Airport opened a $1 billion terminal last fall, replacing a structure that is four decades old with a much larger terminal and concourse.

What had been a nearly $1.3 billion project shrank to $1 billion after airport executives shelved plans for a hotel and parking garage during the recession.

Sacramento International had a hotel on site before the new Terminal B was constructed. The 89-room Host Sacramento Airport Hotel closed in August 2008 and was leveled to make room for the new terminal.

Sonnenblick’s proposal was the only one submitted by the Jan. 30 deadline in response to a request for proposals issued Nov. 3.

Sonnenblick proposes a full-service 200-room hotel and a more limited service hotel with 132 rooms.

The company’s proposal estimates gross revenue of $19.2 million in the first year and $30.4 million by year 10.

Melanie Turner covers energy, environment, clean technology, agriculture, transportation, media and marketing for the Sacramento Business Journal.

Sacramento Business Journal

Date: Wednesday, April 11, 2012, 7:45am PDT

Sonnenblick Industries Inc. has proposed financing the development of two hotels at Sacramento International Airport, three years after plans for an airport hotel were scrapped because of the flailing economy.

The Sacramento County Board of Supervisors is set Wednesday to consider negotiating an agreement with the Pacific Palisades company for the design, development and operation of two hotels on airport grounds.

If the board agrees to move forward on such a project with Sonnenblick Industries, airport staff would begin negotiations with the company to finalize other terms and conditions, such as rent. The board would consider a more fully negotiated agreement at a later date.

Sacramento International Airport opened a $1 billion terminal last fall, replacing a structure that is four decades old with a much larger terminal and concourse. The Big Build was the largest public works project in Sacramento history.

What had been a nearly $1.3 billion project shrank to $1 billion after airport executives shelved plans for a hotel and parking garage.

Sacramento International had a hotel on site before the new Terminal B was constructed. The former Host Sacramento Airport Hotel closed in August 2008 and was leveled to make room for the new terminal.

Meanwhile, the Sacramento County Airport System has been researching the possibility of bringing back a hotel since early last year. The airport system hired Dallas-based Corgan Associates Inc. to identify potential hotel sites. Corgan identified a site between terminals A and B, and another between Terminal B and the airside concourse.

The county moved ahead Nov. 3, issuing a request for proposals. Sonnenblick’s proposal was the only one submitted by the Jan. 30 deadline.

Sonnenblick proposes two hotels, with 132 and 200 rooms. One hotel would feature a 20,400-square-foot conference and meeting space, business center, pool, full-service spa and fitness center.

Sonnenblick proposes a “strong development team” of three primary companies:

- Los Angeles-based real estate development firm Sonnenblick Development would be responsible for financing, marketing and public relations. The company is known for creating unique and innovative lease and financing structures, and for projects such as The Ritz Carlton Hotel in Pasadena and the Los Angeles World Trade Center.

- Gold River-based Tricorp Hearn Construction Inc. would be the general contractor. Local hotel projects have included Le Rivage Hotel on the Sacramento River, Hyatt Place Hotel at the University of California Davis and the Hampton Inn & Suites Hotel West Sacramento.

- San Francisco-based RYS Architects would provide architectural services. Local projects have included the Best Western in Rancho Cordova and Homewood Suites by Hilton in Natomas.

Sonnenblick has proposed financing both hotels. The company’s proposal estimates gross revenue of $19.2 million in the first year and $30.4 million by year 10, according to a county staff report.

PRESS RELEASE:

For public distribution 4‐5‐2012

Los Angeles‐based real estate developer Robert Sonnenblick of Sonnenblick Development LLC has been chosen by Opal Financial Group to lead its Hotel Industry Panel at the upcoming “Real Estate Investors Summit”. The deal‐making conference will be located at The Perry Hotel on South Beach (Miami), Florida on April 27th at 10am.

Also joining Mr. Sonnenblick on the panel will be Mr. Ben Cary, Director of Development at Starwood Hotels, and Mr. Chris Cargen, President of Hospitality America, Inc.

For more information, please see www.Opalgroup.net and www.SonnDev.com

4 TRENDS SHAPING NYC HOSPITALITY

http://www.bisnow.com/new-york-real-estate/2012/03/27/4-trends-shaping-nyc-hospitality

Our 275 attendees walked into Bisnow’s NY Hotel Investment Summit last Thursday at the Marriott Marquis to Creedence Clearwater Revival’s “Have You Ever Seen the Rain?” But they won’t find dark clouds in the sector. “We’ve bottomed out and the next six to nine months will definitely be an upside,” said Sonnenblick Development chairman Bob Sonnenblick, who joined us all the way from Pacific Palisades, Calif. (It’s amazing how willing people are to travel when they’ve got good news to share.)

1) LUXURY AND BOUTIQUE DEVELOPMENT

It’s a unique period for NYC hospitality, says Tribeca Associates partner Mark Gordon—we’re experiencing development that we haven’t seen in previous cycles in New York, including the construction of four- and five-star hotels, which had already happened in other markets. “A dozen have opened or are under development,” he says. Even non-traditional locations, like TriBeCa and SoHo, have seen new high-quality, independent hotels. (Like the firm’s Smyth Hotel & Residences on 85 West Broadway.)

2) BIG NAME NOT REQUIRED

And NYC has the ability to absorb new supply—we saw 15,000 new keys between 2010 and 2011, all while increasing rates, Gemini Real Estate Advisors CEO Will Obeid points out. And you don’t have to be a big name to operate here unless you’re looking for a 600-room hotel, notes the owner of the boutique GEM Hotels. “The Ace Hotel on West 29th Street nailed it,” he says. “It’s got its finger on the pulse of the market and is a great brand.” There once was a huge need for brands (and there’s always a segment crazy about hotel rewards points), but the Expedias of the world minimize the need for those brand reservation systems. “You’re your own travel agent now,” Bob says.

3) SAFETY & DIVERSIFICATION

The challenge: equity investors and lenders see safety in traditional reservation systems, which may not work for a particular hotel, Will says. Outside of NYC, according to Bob (above), you need a flag to get a reaction from lenders. (No word on how banners or coats of arms affect them.) Barriers are not high in the outer boroughs, so they’re getting more hotels than they need and the stabilization period is protracted, the panelists say. But nothing in New York is easy, Mark added. Tribeca Associates has a hotel under development on 20 W 53rd St, across from the MoMA, a mix of five-star hotel rooms and residential condos with hotel amenties. Mixed-use can be better from a lender’s perspective—they love diversification of income.

4) LONG-TERM PERSPECTIVE

Moderator extraordinaire Sonia Kaur Bain, partner at Troutman Sanders. One switch Bob’s firm has made was moving away from 25-story hotels into more low-rise developments with larger rooms—it lowers construction costs and numbers work out a lot better. And construction prices will increase for the foreseeable future. But for now, Will says he’s still getting competitive pricing as subcontractors are hanging on by their fingernails. It’s a great time to develop if you can acquire land at a reasonable price, he says, because financing is available. Keep in mind: it takes a year for design, approvals, and getting a flag on board; two or three years to build; and another two or three years to stabilize, Bob warns.

The bright-eyed and bushy-tailed crowd.

Among the audience, we snapped Eugene Nicotra and Fred Grapstein, both of whom work in hospitality for Vornado, which recently acquired a 42% interest in the Crowne Plaza. Fred tells us the firm’s wholly owned, 1,705-key Hotel Pennsylvania hosted a record 1.1 million hotel guests last year, half from overseas. Fred says he also directs a 501(c)(3) women’s college summer softball program that finished third in the country two years ago, and Gene is the proud papa of new baby boy Joey.

A big shout-out to our sponsors at Emerge212, which operates boutique office, virtual, and concept space at 1515 Broadway and 28 W 44th St. The firm’s Keith Fearon, here with Meghan Betz, tells us that two new tenants have just signed at 1515 (next door to the morning’s event): MunchNYC, a digitized restaurant club that will be offering daily deals of at least 25% off at NY’s best restaurants; and Easy Vista (formerly known as Staff & Line), which provides IT service and asset management. Learn more about our sponsor here.

Keller Augusta Partners’ Kate Keller, Humanscale’s Ellen Hains, WorkSpaces’ Mindy Williams-McElearney, Keller Augusta Partners’ Jodi Shaw, and Marcus & Millichap’s Karen Dome. Good news from the real estate recruiters Keller Augusta—architecture and construction firms are hiring again, particularly in the multifamily sector. And tonight, NYCREW (Karen is prez) is holding a seminar on building your brand in the digital age (more info here).

Sonnenblick on land acquisition spree

12 December 2011 7:44 AM By Shawn A. Turner

Story Highlights

Sonnenblick Development LLC used US$100 million raised in an equity fund to acquire seven tracts of land to be used for resort hotel developments.

The economic downturn provided an opportunity for Sonnenblick to go on its buying spree.

The US $25 billion of CMBS debt scheduled to mature in 2012 could hinder the industry’s comeback.

[read more ]

LOS ANGELES—Sonnenblick Development LLC has invested US$100 million during the past two years to acquire seven tracts of land on which to build luxury resorts in the United States.

The US$100 million represents all the capital raised by Sonnenblick as part of an equity fund put together “when everyone else was running away from the hotel development business,” Bob Sonnenblick, the company’s principal, said during a recent telephone interview.

The seven full-service projects are in various stages of development, Sonnenblick said. He declined to provide details about the resorts, such as location, until the properties have broken ground. He did say the resorts would be in waterfront locations with golf courses. The land was acquired in 2010 and 2011, he said in a follow-up email.

“I don’t want to say I’m building on the west side of Manhattan and then have 10 other guys looking around the west side of Manhattan,” he said. In his email, Sonnenblick said the properties would be held under such flags as Ritz-Carlton, Westin and Hyatt. His firm will hire third-parties to operate the hotels.

He also wrote the firm intends to hold the properties for the “long term.” In addition to the seven land buys, Sonnenblick said the firm is doing three more development deals on the grounds of two “major” U.S. airports. The smaller airport hotels are “3-star” projects, he added.

Los Angeles-based Sonnenblick has other hotel developments in its history. The firm also was behind the Loews Santa Monica in California; the Boca Raton Resort & Club, a Waldorf Astoria Resort in Florida; and the Ritz Carlton at Treasure Hill in Park City, Utah. Sonnenblick said his firm is again jumping into the hotel development game in an effort to get out in front of the sector’s recovery.

Opportunity in the downturn

The economic downturn provided an opportunity for Sonnenblick to go on its buying spree.

“The lowered land prices and construction costs and interest rates make a lot of these deals pencil out better than they have in the last four years,” he said. “That’s part of our industry that excites me; that and in addition to that the fact that 90% of my competition is bankrupt and shoe salesmen somewhere.”

Though terms are not as rosy as they were a few years ago during the heady days of 2007, Sonnenblick was able to secure financing for the developments. Owning the land free and clear provides some sway with the banks, he said. He did not disclose how much equity the firm is providing for the projects.

Construction financing also is available—to a certain extent, Sonnenblick said. “I don’t (consider) 55% of construction costs a great loan,” he said.

Sonnenblick believes the hotel financing environment will loosen in 2012. By the third or fourth quarter of 2012, Sonnenblick said lenders should begin to see there is little threat to them if they open up to providing loans at higher loan-to-value rates.

CMBS problems in 2012

Still, it could well be the financing market that hurts the hotel sector’s attempts at a comeback. The US$25 billion in commercial, mortgage- backed securities that mature next year might present a big problem for the industry, Sonnenblick said.

The industry will not be able to refinance that big a chunk of CMBS debt, and instead of worrying about their properties, hoteliers will begin worrying about their properties’ debt, he said. Not focusing on their hotels will cause operating performance at hotels to suffer, Sonnenblick said. “It takes your eyes off the ball.”

12 December 2011 7:44 AM By Shawn A. Turner Finance Editor Shawn@HotelNewsNow.com

Copyright © 2004-2011 Smith Travel Research /DBA HotelNewsNow.com (HNN). All Rights Reserved.

VOLUME XLIX, NUMBER 9 Your Local News Source Since 1963 SERVING DUBLIN • LIVERMORE • PLEASANTON • SUNOL THURSDAY, MARCH 1, 2012

The Livermore City Council approved a negotiating rights agreement with Sonnenblick Development LLC on a proposal to build a luxury hotel in downtown Livermore.

The council vote was unanimous, with some concerns about potential massing to be addressed in the near future.

The negotiations will provide terms for the purchase of property located at the southeast corner of Railroad Avenue and South Livermore Avenue. The site is currently occupied by SpeeDee Oil Change and a parking lot.

The property is designated as a hotel site in the Downtown Specific Plan. The developer has been involved with prior hotel projects including the Loews Santa Monica Hotel, the Waldorf Astoria Boca Raton Restort, and Le Rivage Resort & Spa in Sacramento. Proposed in Livermore is a four story, 192 room hotel with a restaurant, bar, meeting rooms, fitness center, pool and spa. The hotel will resemble a cluster of buildings.

Councilmember Laureen Turner requested a clarification on who owns the property. She also said she was concerned about the size of the structure and aesthetics, asking if the council could make changes in the proposal when it comes before it.

Eric Uranga, Assistant Community Development Director, explained that the size, type and look of the hotel would be part of the negotiation process. The terms and conditions of the agreement would come back to the council for approval.

Uranga explained that the site was previously owned by the Redevelopment Agency. It was transferred to the city earlier this year. Uranga stated, “It is in jeopardy. The ownership will be reviewed by an oversight committee, which will determine whether the land should be disposed of or if it can be held by the city.”

Councilmember Stewart Gary asked that the city take a look at all of the rooms and conference space that would be needed in the downtown. If not all of the rooms and meeting space required could not be accommodate on the proposed site, would the city need to provide a nearby parcel.

Gary also wanted the city to have a say in who would operate the hotel. He suggested that there are more boutique operators available than those listed by Sonnenblick. “Let’s go fishing,” he stated.

Councilmember Bob Woener also wanted to take a look at the massing of the proposed hotel as soon as possible. He wanted the council involved in the actual design before it had gone too far. “It is important to involve us in what it looks like,” he declared.

The negotiations are scheduled over a period of four months. That allows time for further design development and plans for a finance package to proceed. The council would have two more looks at a design before it would be finalized.

In the application, Sonnenblick writes, “Our vision is to develop a first class luxury hotel on a property that we believe is the finest site in the entire City of Livermore. Because it is also the gateway to the downtown area, it must make an architectural statement, instead of having a plain vanilla facade.”

According to Robert Sonnenblick, the hotel would draw visitors from the surrounding businesses and industries in the region, including the wine industry. Proposed are street level retail and/or restaurant space. The five potential operators for the Livermore hotel are Hilton, Marriott, Intercontinental Hotel Group, Hyatt and Starwood.

By Todd Leskanic Staff writer

Article from Fayobserver.com

SOUTHERN PINES – A California developer has picked a different site, near U.S. 1 and Midland Road, for a proposed retail outlet center with hotels and a golf course.

Bob Sonnenblick of Sonnenblick Development said he is no longer interested in a 114-acre property on Morganton Road that he had previously discussed.

His new focus for a 335,000-square-foot outlet center, three high-end hotels and a golf course is 550 acres near the Pine Needles Lodge & Golf Club. The same site was previously proposed for the controversial 800-home Pine Needles Village development, which the Southern Pines Town Council voted down in 2008.

“The U.S. 1 site has a huge amount of highway frontage and visibility and much better access than the other properties we looked at,” Sonnenblick said. “So we’re really thrilled to have finally landed in the right spot within the Pinehurst-Southern Pines marketplace.”

Sonnenblick said potential tenants also were uncomfortable with traffic issues at the Morganton Road site and feared that high infrastructure costs would drive up rents at the outlet center.

An outlet center would be the first of its kind in the Cape Fear region. The closest centers for outlet shoppers are in Smithfield, Charlotte, Burlington, the Triangle and Myrtle Beach, S.C.

No property has changed hands. The 550 acres are owned by the Bell family, who own Pine Needles and the Mid Pines Inn & Golf Club, which is across Midland Road.

Kelly Miller, president of the resorts, said the family has acquired a bulk of the property since the late 1980s.

“We knew we were going to develop this acreage somehow or other,” Miller said. “We had attempted to to do this with Pine Needles Village several years ago, so now we think it makes sense to master plan the entire tract and move forward.”

Sonnenblick said the outlet center would be built first. He said he plans to bring in four-star hotel brands for the 300-room hotels, and he described the golf course as “championship high-end.” Roughly 100 acres would be kept vacant for wetlands and include a horse trail, he said.

The goal is to have the outlet center open in time for the 2014 U.S. Open Championship and U.S. Women’s Open Championship.

Sonnenblick was in Moore County for three days last week and met with officials from Southern Pines and the county to discuss the proposal.

“We got very positive feedback,” he said. “The reason for that is we’re going to create in excess of 1,000 jobs and millions of dollars of sales and bed tax from a property that is now vacant.”

Staff writer Todd Leskanic can be reached at leskanict@fayobserver.com or 486-3511.

Europe’s banks are going to be forced into selling more distressed property loans in the coming year as borrowers default, a major Bloomberg real estate summit in New York was told this week.

“There’s going to be a feeding frenzy soon” for European loans, said Robert Blumenthal, a managing director at Deutsche Bank Securities Inc. “Someone’s going to have to take those loans out at a significant discount” and inject “huge amounts of equity” to recapitalise the assets.

European lenders have 151.4 billion euros ($204.8 billion) of commercial real estate loans in default, compared with $121 billion at U.S. banks, according to New York- based data provider Trepp LLC, and the hotel and resort sector is a major risk.

The first quarter of 2012 is going to be “grim” the conference heard, and because the CMBS market isn’t coming back fast enough to help borrowers refinance debt coming due, there will be a “huge increase” in U.S. hotel foreclosures next year, said Robert Sonnenblick, a hotel developer.

About $21.7 billion in CMBS (Commercial Backed Mortgage Securities) loans on 232 hotels are coming due in the next 12 months and need to be refinanced, according to Realpoint, a securities ratings firm now owned by Morningstar Inc. At best, a third of that will be refinanced, with many properties being taken over by lenders, Sonnenblick said.

Private-equity firms and real estate companies over the past six months have been staffing up in London in anticipation of bidding for distressed debt in Europe, said Glenn Rufrano, president and CEO of Cushman & Wakefield.

Developer are increasingly talking about how the U.S. hotel world will see a “huge increase'” in foreclosures in 2012 as debts come due and financing remains hard to come by, Bloomberg reports.

A foreclosed hotel is one in which the owner is unable to make mortgage payments.

The lack of money means greater odds that guests will notice cost cutting or signs of a lack of investment, although hotel managers typically try to do the best they can to make sure guests won’t notice their property’s financial troubles.

“You’re going to see a huge increase of hotel foreclosures,” Robert Sonnenblick, chairman of Sonnenblick Development, said during the Bloomberg Commercial Real Estate Summit in New York.

According to another developer, boutique hotel pioneer Ian Schrager, the expected flood of hotel foreclosures is also ruining some plans to build new hotels. Here’s what he told Bloomberg:

“It’s very difficult to build when everybody’s anticipating there’s going to be a flood of existing assets at opportunity costs to buy,” said Schrager, who estimates he can build new hotels in New York City for as little as $400,000 per room.

High-end hotels in major U.S. cities such as New York, Boston and San Francisco have recovered more than other markets so far during the recovery, the piece notes.

In the past couple of years, we’ve seen a range of foreclosures especially at high-end and luxury properties including Starwood’s W Atlanta-Downtown and Capella Telluride hotel in Colorado’s ski country.

05 January 2012

By Shawn A. Turner

Finance Editor

Shawn@HotelNewsNow.com

REPORT FROM THE U.S.—There’s a big bill coming due for the hotel sector in 2012. Billions of dollars of debt (comprised of commercial, mortgage-backed securities, credit facilities, bank and finance company loans and others) matures this year, much of it written during frothier days when underwriting terms were much less stringent than today. In CMBS, for one, there is US$9.1 billion of hotel CMBS debt maturing in 2012; much of it originated in 2007, according to Trepp LLC, a company that tracks the CMBS market. It’s not clear how much balance sheet debt will mature in 2012, though Mathew Comfort, executive VP of global real estate services firm Jones Lang LaSalle, puts that number at roughly twice the size of the CMBS market. Modifying loans

Bob Sonnenblick, principal of real-estate development firm Sonnenblick Development LLC, said all the debt coming due in 2012, particularly the CMBS debt, could prove a distraction to the industry as executives spend more time figuring out ways to refinance and less time focused on their own operations. “It takes your eyes off the ball,” he said. Sonnenblick said “there is no way” the lenders in the market will be able to refinance all the CMBS coming due. “At best you will see a third (of maturing CMBS) refinanced,” he said. Still, with the debt shadow looming over the industry, hotel companies are scrambling to refinance and restructure. For example, Ashford Hospitality

Trust in December restructured its US $203.4-million securitized mortgage loan that was to mature in December.

Ashford also is working to refinance future maturities, too. The Dallas based real-estate investment trust has US $167.2 million of debt coming due this year; the REIT is in the early stages of restructuring or refinancing the debt.

“We’ve tried to keep a balanced maturity schedule,” Ashford president Doug Kessler said. Joe Epstein, president and founder of First American Realty Associates, a Fairfield, New Jersey-based mortgage lending source for the hotel industry, said debt restructuring in 2012 will be done on a “deal-by-deal, case-by-case basis.”

“The type of lender and the reasonableness of the borrower’s request normally determines the outcome,” he said via email. CMBS outlook The CMBS market saw plenty of fits and starts during 2011, said Jon Winick, president of Chicago-based Clark Street Capital Management LLC, a full-service bank advisory, disposition and asset management firm.

“I think the real-estate market has been very much distracted by CMBS,” he said. “CMBS has been very erratic. It’s in, it’s out. It’s back, it’s not back.”

The stop-and-go nature of CMBS, however, might come to an end in 2012, according to Huxley Somerville, group managing director of Fitch Ratings’ U.S. CMBS group.

During a webinar last month, Somerville said it appears the CMBS market is stabilizing; Fitch noted a slight month-over-month increase in hotel CMBS late pays for November. The delinquency rate for the hotel sector edged up to 12.66% in November from 12.54% during August.

“It, along with multifamily (sector CMBS), is expected to perform the best” in 2012, Somerville said of hotel CMBS.

The biggest threat to AAA-rated CMBS in 2012, Somerville said, would be a loss of liquidity in the market lasting six to nine months. Such an event inevitably would lead to an increased rate of defaults and a decline in property values. Financing availability

Compounding the issue for hotel companies is the general lack of financing availability in the industry for the better part of the last 18 months. Kessler said Ashford’s mortgage loan restructuring was made all the more difficult by the inactive CMBS market that ruled the latter part of 2011. “It’s less available than it was six months ago,” Kessler said of debt. JLL’s Comfort said debt available though underwriting terms have tightened. Helping the U.S. market are foreign lenders who have jumped into the debt market.

Globally, the European market still is a year or two behind where U.S. lending is, Comfort said.

“Europe is obviously in a state of emergency and is trying to figure out the best way to salvage their currencies and economies,” he said. Winick said there should be some loosening of the credit markets in 2012, though.

“Hotel financing is going to get better,” Winick said. “It can only get better.”

Mr. Robert Sonnenblick, Principal of Sonnenblick, LLC, is a graduate of the Wharton School of Finance of the University of Pennsylvania with more than 30 years of experience in various aspects of real estate and real estate finance. From 1981 to 1991 Mr. Sonnenblick was the driving force and power behind Sonnenblick-Goldman Corporation of California. Mr. Sonnenblick completed over $1.5 Billion of commercial real estate transactions on the West Coast and as a result is regarded as one of the West Coast’s leaders in the field of commercial real estate. Among the more notable projects for which Mr. Sonnenblick personally structured the financing for are The Beaudry Center, Los Angeles, California ($197 million), the Ritz Carlton Hotel, Pasadena, California ($97 million), One Waterfront Plaza, Honolulu, Hawaii ($100 million), and the Los Angeles World Trade Center, Los Angeles, California ($55 million).

Mr. Robert Sonnenblick, Principal of Sonnenblick, LLC, is a graduate of the Wharton School of Finance of the University of Pennsylvania with more than 30 years of experience in various aspects of real estate and real estate finance. From 1981 to 1991 Mr. Sonnenblick was the driving force and power behind Sonnenblick-Goldman Corporation of California. Mr. Sonnenblick completed over $1.5 Billion of commercial real estate transactions on the West Coast and as a result is regarded as one of the West Coast’s leaders in the field of commercial real estate. Among the more notable projects for which Mr. Sonnenblick personally structured the financing for are The Beaudry Center, Los Angeles, California ($197 million), the Ritz Carlton Hotel, Pasadena, California ($97 million), One Waterfront Plaza, Honolulu, Hawaii ($100 million), and the Los Angeles World Trade Center, Los Angeles, California ($55 million).

In 1991 Mr. Sonnenblick was appointed Director of Development for the New Jersey and L.A. MetroMalls, with the responsibility for oversight and direction of the design, financing and leasing programs for two proposed $250 million enclosed regional malls totaling 1.2 million Sq. Ft. each. Mr. Sonnenblick personally oversaw more than 1 million Sq. Ft. of leases in connection with this position as well as arranging the necessary debt and equity financing. The New Jersey project opened to one of the strongest starts in the history of the United States mall industry. In addition, Mr. Sonnenblick was an original development partner of the Loews Santa Monica Beach Hotel. This 360-room, $90 million hotel was recently sold for $125 million.

Prior to forming Sonnenblick Development, LLC, Mr. Sonnenblick was the senior partner in a Los Angeles-based real estate development firm (Sonnenblick Del Rio Development) which specialized in public-private partnerships, specifically the development of four major government-leased office buildings throughout the Los Angeles basin. During this tenure, Mr. Sonnenblick successfully developed nearly 1 million square feet of government leased buildings, occupied by such tenants as U.S. Department of Homeland Security, Federal Bureau of Investigation (FBI), Los Angeles County Sheriff’s Department, Los Angeles County Department of Public Social Services and Los Angeles County Department of Children and Family Services.

Mr. Sonnenblick is a frequent speaker at various real estate-related functions, such as those hosted by Deloitte Touche, ICSC, Value Retail News, Crittenden, USC, UCLA Real Estate Program, IMN Real Estate Conferences and the Institute for International Research, The Opal Group, iGlobal Forum Group, Globe Street/Realshare Conferences and Bloomberg Conferences.

Mr. Sonnenblick is a member of the Advisory Board of the Golf Development Institute, a member of the Board of Real Estate Council of the Century City Chamber of Commerce and is a published author on subjects ranging from architecture to general real estate market conditions. In addition to Mr. Sonnenblick’s expertise in development, finance, joint ventures and equity structuring, Mr. Sonnenblick has also been certified as an expert in the area of real estate bankruptcy/foreclosure. Mr. Sonnenblick is a qualified expert witness in the area of Commercial Real Estate Finance and Interest Rates for the United States Federal Court System in numerous jurisdictions.

| 1976 to 1980 |

Wharton Business School at the University of Pennsylvania, B.S. in Economics and Finance |

| 1980 to 1982 |

Real estate financier, Sonnenblick-Goldman Corp., New York NY |

| 1983 to 1992 |

Real estate financier, Sonnenblick-Goldman Corp., Los Angeles CA |

| 1993 to 1998 |

Co-developer and Director of Leasing and Finance, NJ Metromall (now “Jersey Gardens”) a 1.2 million square foot factory outlet mall located on the NJ Turnpike in Elizabeth NJ |

| 1986 to 1998 |

Development Partner and Director of Finance, The Loews Santa Monica Beach Hotel, a 360 room luxury oceanfront 4-star hotel |

| 1987 to 1997 |

Equity Partner, The Boca Raton Resort Hotel, a luxury 4- star, 1000 room resort hotel |

| 1999 to 2001 |

Developed DPSS El Monte #1 (a $39 million class-A office building 100% leased to the County of Los Angeles) |

| 2001 to 2003 |

Developed DPSS West LA (a $36 million class-A office building 100% leased to the County of Los Angeles) |

| 2003 to 2005 |

Developed DPSS – El Monte #2 (a $46 million Class-A office building 100% leased to the County of Los Angeles) |

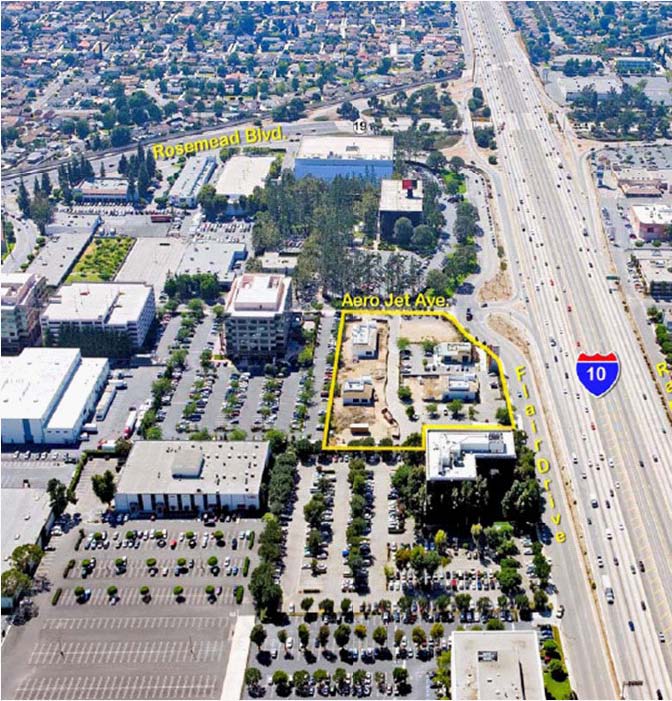

| 2006 to 2007 |

Developed Flair Plaza Shopping Center in Los Angeles on the I-10 freeway at the Rosemead Blvd. off-ramp |

| 2007 to present |

Redeveloped Norwalk Government Center, a 500,000 sq. ft. Class-A office building on Imperial Highway, anchor tenants are State of California (Board of Equalization, Small Business Administration), the County of Los Angeles (Dept. of Public Social Services, Dept. of Children & Family Services, Mental Health Dept., Sheriffs’ Dept.), and the Federal Government (the FBI, Social Security Administration, and Dept. of Homeland Security – Los Angeles County Headquarters) |

| 2011 to present |

Established Sonnenblick Development LLC, a multi-faceted real estate development company specializing in 4-star oceanfront resort hotel developments across the United States, with a particular focus on high-end golf resorts. The company also has a secondary focus on development of airport on-property limited service hotels. Bob Sonnenblick is a featured speaker at many global development, hospitality and funding conferences. [Click for upcoming events] |

- 356 Acres in South Florida

- 1000 Hotel Rooms

- 30 Tennis Courts

- 356 Acres in South Florida

- 1000 Hotel Rooms

- 30 Tennis Courts

Partial List of Significant Projects Presently Being Worked on or Completed in the Past

For a brief summary of the projects recently completed or presently being worked on by Mr. Sonnenblick:

click here.

We have provided details regarding the development process and the stage at which each project is in to allow a better understanding of the degree of development work done to date on the listed projects. You can see that each project has taken a great deal of time in the development process beginning with land acquisition and going through entitlements, environmental, finance, development, and tenanting issues.

SONNENBLICK – DEVELOPMENT CORPORATE RESUME

The principals of Sonnenblick Development have a combined 29 years of experience in real estate, construction, finance and development in excess of $2.5 Billion in closed transactions.

To date the principals are have developed, among other things:

- The development of a 120,000 square foot LA County Department of Public Social Services Building.

- The development of a 120,000 square foot LA County Department of Children’s and Family Services Building.

- The development of a 70,000 square foot LA County Department of Public Social Services Building.

- The development of a 25,000 square foot multi-tenant retail shopping center.

- The acquisition of an existing 500,000 square foot office building, which is now leased to the County of Los Angeles, the State of California and U.S. Federal Government.

- The development of a 360-room beach-front resort hotel.

Sonnenblick Development References

- Deutsche Bank, New York, New York

- Bank of America, Santa Monica, California

- Cathay Bank, Los Angeles, California

- US Trust Co., Los Angeles, California and Boca Raton, Florida

- Pacific Coast Capital Partners, El Segundo, California

- Bank of New York, Los Angeles, California

The principals of Sonnenblick Development have a combined 30 years of experience in real estate, construction, finance and development in excess of $2.5 Billion in closed transactions.

- Beach Front Hotel in Santa Monica, CA

- 360 Rooms

- 5 years to Entitle Project

- Built for $90,000,000

- Sold for $125,000,000

- Co-Developer & Equity Investor

- 1.2 Million Sq. Ft.

- 16 Anchor Stores

- Original Developer

- Proposed Waterfront Hotel

- 325 Hotel Rooms

- $100,000,000

- Project Developer

DEPARTMENT OF PUBLIC SOCIAL SERVICES

- Located in West Los Angeles, CA

- 70,000 Rentable Sq. Ft.

- Four Story Structure

- Project Developer

Mr. Robert Sonnenblick, President of Sonnenblick Development, LLC, is a graduate of the Wharton School of Finance of the University of Pennsylvania with more than 30 years of

Mr. Robert Sonnenblick, President of Sonnenblick Development, LLC, is a graduate of the Wharton School of Finance of the University of Pennsylvania with more than 30 years of

experience in various aspects of real estate and real estate finance. From 1981 to 1991 Mr. Sonnenblick was the driving force and power behind Sonnenblick-Goldman Corporation of California. Mr. Sonnenblick completed over $1.5 Billion of commercial real estate transactions on the West Coast and as a result is regarded as one of the West Coast’s leaders in the field of commercial real estate. Among the more notable projects for which Mr.

Sonnenblick personally structured the financing for are The Beaudry Center, Los Angeles, California ($197 million), the Ritz Carlton Hotel, Pasadena, California ($97 million), One Waterfront Plaza, Honolulu, Hawaii ($100 million), and the Los Angeles World Trade Center, Los Angeles, California ($55 million).

[Click for full Bio]

PHASE II DEPARTMENT OF CHILDREN & FAMILY SERVICES

- 120,000 Rentable Sq. Ft.

- The Building Sits Next to Phase I of the El Monte DPSS Campus that Includes an 834-Car, Seven-Story Parking Garage that has Granite Highlights.

- Incorporates a 10,000 Square Foot Day Care Facility (2,500 Interior and 7,500 Exterior),

- 120,000 Rentable Sq. Ft.

- Six-story Structure with One Floor Subterranean

- Project Developer

DEPARTMENT OF PUBLIC SOCIAL SERVICES

- 120,000 Rentable Sq. Ft.

- Six-story Structure with One Floor Subterranean

- Project Developer

Project Details

- Norwalk, CA

- L.A. Headquarters of the Dept of Homeland Security

- 500,000 Sq. Ft.

- 7-Story Office Building

- Tenants Include the County Of Los Angeles and The State Of California

- Project Developer

Tenants Include

- Homeland Security/USA

- The FBI/USA

- LA County Sheriff Dept.

- LA County Dept of Social Services

- LA County Mental Health

- LA County Children & Family Services

- State of Calif Board of Equalization

- State of Calif Small Business Administration

- Accenture Inc.

- The Social Security Administration

- Located in Los Angeles, CA

- 30,000 Sq. Ft.

- Sold for $14,000,000

- Project Developer

Bob noted that in all of his design-build contracts, he throws 100% of the risk onto the shoulders of his general contractors; there’s surely bonding, as well. “I can go to sleep for two years and that thing still gets developed the way I want it to.” (Though there are other reasons why he shouldn’t sleep for two years: Chief among them, who wins the Super Bowl.) Among the barriers, he cited entitlement process issues such as traffic and neighborhood groups. For Kristina, the challenge is carpetbaggers with no vested interest in a neighborhood who come in and make claims. The huge specific plan USC is trying to entitle is a case in point: A group asked for $250M in exchange for non-opposition. (Support would cost extra.)

Bob noted that in all of his design-build contracts, he throws 100% of the risk onto the shoulders of his general contractors; there’s surely bonding, as well. “I can go to sleep for two years and that thing still gets developed the way I want it to.” (Though there are other reasons why he shouldn’t sleep for two years: Chief among them, who wins the Super Bowl.) Among the barriers, he cited entitlement process issues such as traffic and neighborhood groups. For Kristina, the challenge is carpetbaggers with no vested interest in a neighborhood who come in and make claims. The huge specific plan USC is trying to entitle is a case in point: A group asked for $250M in exchange for non-opposition. (Support would cost extra.) Dining with us in his work clothes at BOA Steakhouse in Santa Monica Wednesday evening, Bob Sonnenblick demonstrates why he left New York 30 years ago to come west. Well, in addition to the fact that the renowned company founded by his grandfather in 1910, which financed much of New York’s skyline made him head of West Coast operations where he helped finance much of downtown LA’s booming skyline in the ’80s. Nearly 25 years ago he went on to start Sonnenblick Development, which has not only developed numerous federal and commercial office buildings, but also resorts in places like Park City, Palm Springs, and Palm Beach, where he can also get fresh air and additional use of his colorful shirts.

Dining with us in his work clothes at BOA Steakhouse in Santa Monica Wednesday evening, Bob Sonnenblick demonstrates why he left New York 30 years ago to come west. Well, in addition to the fact that the renowned company founded by his grandfather in 1910, which financed much of New York’s skyline made him head of West Coast operations where he helped finance much of downtown LA’s booming skyline in the ’80s. Nearly 25 years ago he went on to start Sonnenblick Development, which has not only developed numerous federal and commercial office buildings, but also resorts in places like Park City, Palm Springs, and Palm Beach, where he can also get fresh air and additional use of his colorful shirts.

Mark D. Payne

Mark D. Payne