Bob Sonnenblick CaRE, USC Hyatt House Hotel EB-5 Project

CaRE, USC Hyatt House Hotel EB-5 Project

CaRE, USC Hyatt House Hotel EB-5 Project

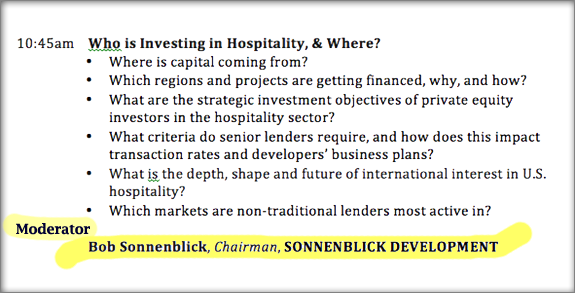

PERE Conference Corp. has announced that Los Angeles-based real estate developer, Mr. Robert Sonnenblick, Chairman of Sonnenblick Development LLC, has been chosen to moderate a real estate panel at their upcoming PERE Real Estate Summit in NY on November 11th, 2015.

The panel is titled: “The Cycle continues, a correction is inevitable…”.

For more info, go to www.perenews.com

12:10 As the cycle continues a correction is inevitable: Balancing investments for a future downturn

How are we factoring the anticipation into our investment strategy now? Will there be appreciation in both long/short term assets?

Moderator:

Mr. Robert Sonnenblick, Chairman, Sonnenblick Development LLC

Panel Members:

Todd Henderson, Head of Real Estate, Americas Deutsche Asset & Wealth Management

Chris McEldowney, Managing Director, Real Estate, New York Life Real Estate

Jay Morgan, Senior Consultant, Courtland Partners

Press Release: New York City. New York

Real Estate Capital Magazine has announced that Los Angeles-based real estate developer Robert Sonnenblick, Chairman of Sonnenblick Development LLC, has joined the agenda for their upcoming Real Estate Capital Finance Forum to be held in NYC on Monday November 9th. Mr Sonnenblick will moderate the “Real Estate Cycle” panel. The conference will be held at the Convene Conference Center on Third Avenue, and will begin at 8am. Conference Registration is available at (646)-854-7950.

3:45 Panel session

Hear from the borrowers: where are we in the real estate cycle?

Moderator:

Bob Sonnenblick, Chairman, Sonnenblick Development, LLC

Panelists:

Chris Niehaus, Partner, GreenOak Real Estate

Christa Chambers, Chief Financial Officer, Kemper Development Company

Phil Watkins, Principal, Megalith Capital

Click for more information

Oct 20, 2015

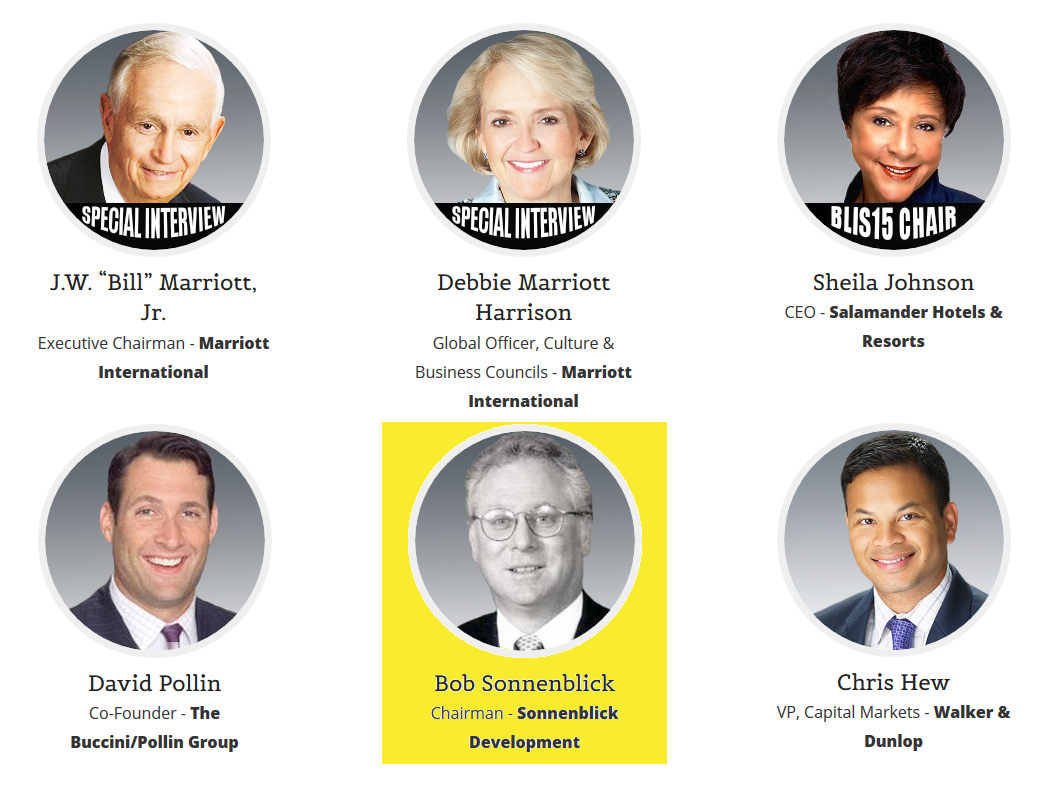

click for full article on BIZNOWWhile Bill and Debbie were the highlight of the day, the 400 or so attendees were treated to a Sheila Johnson keynote and state of the hotel industry, covered yesterday. In the afternoon, the crowd was given an update on EB-5 financing from a panel of Polsinelli’s Dawn Lurie, Wright Johnson’s Aaron Goforth (he’s the one with the man-bun), Sonnenblick Development CEO Bob Sonnenblick, EB5 Capital founder Angel Brunner, who moderated in the style of Anderson Cooper, Homeier & Law’s Clem Turner, and NES Financial’s Reid Thomas. EB-5 is a vehicle for immigrants to invest in real estate. It’s a convoluted and complicated process, but it can be worth it. “The bottom line is always money,” Bob says. “The EB-5 mezzanine deal we just finished was at 6%. If you’re able to borrow mezz money at 6 instead of 12% to 13%, it’s going to save you millions of dollars over your transaction.”

The now legendary lone fir stands out amid the rolling landscape of the links style golf course at Chambers Bay. An 18-hole golf course and a large resort-hotel are no longer planned for Chambers Bay in University Place. Instead, Pierce County officials have asked the California developer behind the project for a smaller development. Dean J. Koepfler Staff file

By Brynn Grimley

Staff writer

An 18-hole golf course and a large resort-hotel are no longer planned for Chambers Bay in University Place.

Instead, Pierce County officials have asked the California developer behind the project for a smaller development.

“We didn’t feel from a county perspective that it was realistic to have a development predicated on the building of a new golf course,” deputy county executive Kevin Phelps said last week.

The county’s request came after the U.S. Open in June.

The space the USGA tournament took up outside the county-owned Chambers Bay golf course made county officials realize a second golf course didn’t make sense, Phelps said.

Last year, Los Angeles developer Bob Sonnenblick proposed a $150 million resort-style golf course and hotel on the southern portion of the 930-acre Chambers Creek property.

The course was planned for directly south of the Chambers Bay golf course with Chambers Creek Regional Park as a buffer. The hotel was proposed off Grandview Drive, near the entrance to the park.

“We feel that even though we could technically squeeze another 18 holes in, it might make it so we’re not competitive for a future (golf) event,” Phelps said.

County leaders want to host future golf tournaments, including another U.S. Open at Chambers Bay.

Sonnenblick, who owns Sonnenblick Development, is working on a new proposal.

“We understand the county’s reason for this decision, and we have no problem with it,” Sonnenblick wrote in an email to The News Tribune last week.

Losing the golf course means a smaller hotel, he said.

“Clearly without the second ‘resort’ (golf) course we would no longer be able to justify building a large, 300-plus room resort hotel in one big phase,” Sonnenblick wrote.

Previously a dramatic, five-story hotel with sweeping views of Chambers Bay golf course and Puget Sound was planned.

Plans included a 258-room hotel, conference center, 180-seat cafe and restaurant, and a swimming pool. The conference center was proposed for what now is the county’s environmental services building, with a ballroom added on.

“We have redone our feasibility studies and appraisals to divide this hotel development into two phases,” Sonnenblick wrote, “the first of which will be approximately half the size of what we had planned before.”

Sonnenblick expects to have new project renderings to the County Council soon.

“We are very excited about how the new, smaller, hotel layout sits (on) the land parcel and how well it works with the site’s current long-term master plan,” he said.

The county’s decision to request a scaled-back development was “partially economic and partially making sure that we have the ability to use that property for a variety of uses,” Phelps said.

After seeing architectural drawings for the hotel a year ago, at least two County Council members cited concern with impeding the public’s ability to access the site.

Public amenities include trails, parks and playground as well as the golf course.

“That is the public’s property,” Councilwoman Connie Ladenburg said at the time. “To make sure that (residents) still feel that that’s their property, I think, is very key with any development that we do out there.”

Sonnenblick maintains he will develop a project that promotes pedestrian accessibility to the site.

Brynn Grimley: 253-597-8467

Nick Griffin

Director

Central City Association and Downtown Center BID

Jay Newman

COO

Athens Group

Maki Bara

President

The Chartres Lodging Group

Bob Sonnenblick

Principal

Sonnenblick Development

8:00-9:00 AM Breakfast & Networking

9:00-10:30 AM All-Star Panelists

10:30-11:00 AM Post-Panel Networking

![]()

Intercontinental Century City

Avenue of the Stars

Los Angeles, CA 90067

Floor Level: 1st Ballroom: Grand Salon

Parking Information: Valet only, $16/day

Los Angeles’ hospitality market is booming! Downtown LA is in the middle of a renaissance, making it a magnet for both national and international visitors. DTLA offers plenty of red-carpet events, conferences, incredible restaurants, hip amenities and world class attractions. Urbanization and favorable government regulations are promoting new lodging developments in submarket areas, such as the Fashion District, Art District and Chinatown. Come join key players examining the current state of LA’s hospitality market and discussing economic key drivers and hotel trends that impact tourism and hospitality investments. We will also assess future trends of the DTLA lodging market. And of course, there will be plenty of schmooze & networking time!

![]()

BOB SONNENBLICK

BOB SONNENBLICKMr. Robert Sonnenblick, Principal of Sonnenblick Development, LLC, is a graduate of the Wharton School of Finance of the University of Pennsylvania with more than 30 years of experience in various aspects of real estate development and real estate finance. From 1981 to 1991 Mr. Sonnenblick was the driving force and power behind Sonnenblick-Goldman Corporation of California. Mr. Sonnenblick completed over $1.5 Billion of commercial real estate transactions on the West Coast, and as a result is regarded as one of the West Coast’s leaders in the field of commercial real estate finance. Among the more notable projects for which Mr. Sonnenblick personally structured the financing for are The Beaudry Center, Los Angeles, California ($197 million), the Ritz Carlton Hotel, Pasadena, California ($97 million), One Waterfront Plaza, Honolulu, Hawaii ($100 million), and the Los Angeles World Trade Center, Los Angeles, California ($55 million).

In 1991 Mr. Sonnenblick was appointed Director of Development for the New Jersey and L.A. MetroMalls, with the responsibility for oversight and direction of the design, financing, and leasing programs for two proposed $250 million enclosed regional malls totaling 1.2 million square feet each. Mr. Sonnenblick personally oversaw more than 1 million square feet of leases in connection with this position as well as arranging the necessary debt and equity financing. The New Jersey project opened to one of the strongest starts in the history of the United States mall industry. It is now re-named Jersey Gardens Outlet Mall.

In addition, Mr. Sonnenblick was an original development partner of the Loews Santa Monica Beach Hotel. This 360-room, $90 million hotel was sold for $125 million.

Prior to forming Sonnenblick Development LLC, Mr. Sonnenblick was the senior partner in a Los Angeles-based real estate development firm (Sonnenblick Del Rio Development) which specialized in P-3 public-private partnerships, specifically the development of four government leased office buildings across the Los Angeles basin. During his tenure there as Chairman, Mr. Sonnenblick successfully developed nearly 1 million square feet of government-leased buildings, occupied by such tenants as U.S. Department of Homeland Security, the Federal Bureau of Investigation (FBI), the Los Angeles County Sheriffs Department, Los Angeles County Department of Public Social Services, The Small Business Administration (SBA), the LA County Mental Health Dept, The Social Security Administration, and Los Angeles County Department of Children and Family Services.

Mr. Sonnenblick is a frequent speaker and panelist at various real estate-related functions, such as those hosted by Deloitte Touche, ICSC, Value Retail News, Bloomberg News, Crittenden Conference Co., USC Real Estate, UCLA Real Estate, IMN Real Estate Conferences, Bisnow Media, Opal Conference Group, iGlobal Forum, and the Institute for International Research. Mr. Sonnenblick is a published author on subjects ranging from commercial architecture to general real estate market conditions. In addition to Mr. Sonnenblick’s expertise in development, finance, and joint ventures, Mr. Sonnenblick has also been certified as an expert witness in the areas of real estate bankruptcy/foreclosure and finance. Mr. Sonnenblick is a qualified expert witness on the topic of Commercial Real Estate Interest Rates and Finance for the United States Federal Court System in numerous different jurisdictions across the State of Calif, Nevada, and Arizona.

LodgePress Release: Scottsdale, Arizona

The Lodging Conference, one of the nation’s premier Hotel Industry annual events, is pleased to announce that Los Angeles-based hotel developer Bob Sonnenblick, Chairman of Sonnenblick Development LLC, has agreed to join the “EB-5 and Crowdfunding” panel at their upcoming conference on October 7th at The Arizona Biltmore Hotel in Scottsdale, Arizona. The panel will focus on alternative methods to fund new hotel projects and acquisitions.

11:00 – 12:15

CONCURRENT THINK TANKS

T-2: EB-5 and CrowdFunding: Innovative Options for Your Next Hotel Project

Learn how EB-5 and crowdfunding work as the panel reviews the benefits and pitfalls including legal, regulatory and legislative issues, fees, risk, marketing and timeline to meet your fundraising goal for new construction, acquisition or renovation.

Moderator:

David Eisen, Editor-in-Chief Hotel Management Magazine

Panelists:

Tim L. Edgar, Founder & President, Hotel Innvestor

Julie Richter, Chief Financial Officer Concord Hospitality Enterprises Company

Bob Sonnenblick, Chairman, Sonnenblick Development LLC

Gregory Steinhauer, President, American Life Inc.

For more information, please call (800)-252-3540 or email: info@lodgingconference.com

Or go to: www.Lodgingconference.com

IMN Crowdfunding Conf Press Release: Santa Monica, California

NY-based IMN Real Estate Conferences is pleased to announce its 2nd Annual Crowdfunding Forum for Real Estate, to be held on September 17th at the Fairmont Miramar Hotel in Santa Monica.

The lead panel will be moderated by Los Angeles developer Bob Sonnenblick, Chairman of Sonnenblick development LLC, and it will focus on:

The Future of Crowdfunding as a Money Source for Real Estate Projects.

For more info, go to www.IMN.org or call (212)-224-3207.

PRESS RELEASE: July 8th, 2015

Bob Sonnenblick, Chairman of Los Angeles-based Sonnenblick Development LLC, has been chosen by Bisnow Conferences to be one of the lead panelists at their upcoming 4th Annual Lodging & Investment Conference in Washington DC on October 19.

PRESS RELEASE: 4-20-15

Los Angeles-based real estate developer Bob Sonnenblick has joined the Real Estate Finance panel at the upcoming CFO Forum Conference in San Diego on May 4th. The conference is run by IMN Conferences Inc and will be held at The Park Hyatt Aviara Resort in Carlsbad. The topic of Sonnenblick’s panel is “Real Estate Fundraising: Navigating Different Sources of Capital”.

| 10:00 AM Fundraising: Navigating Different Sources of Capital |

Moderator:

Joseph V. Delaney, CEO, J.V. DELANEY & ASSOCIATES [

BIO ]

Panelists:

Jeff Zuckerman, CFO Western Regions, ALLIANCE RESIDENTIAL COMPANY

[BIO ]

Jerome Fink, Managing Partner, THE BASCOM GROUP, LLC

[BIO ]

Tim Trifilo, Tax Partner and National Tax Lead, COHNREZNICK LLP

Charlie Kellogg, CFO/COO, SINGERMAN REAL ESTATE, LLC

[BIO ]

Bob Sonnenblick, Chairman, SONNENBLICK DEVELOPMENT, LLC

[ BIO ]

|

|

|

|

|

|

Hotel developer Bob Sonnenblick, Chairman of Los Angeles based Sonnenblick Development LLC, has been chosen by Crittenden Conferences Inc. to moderate its “California Real Estate Development – 2015” panel at the upcoming Crittenden National Real Estate Conference in San Diego, California.

The conference will be held at The S.D. Omni Hotel, next door to The San Diego Convention Center, on April 28-30, 2015.

Hour 3: Wednesday, April 29th – 12:00pm – 1:00pm

Moderator: Bob Sonnenblick, Chairman – Sonnenblick Real Estate LLC

John Santry, Executive Vice President of Acquisitions and Development – Shopoff Realty Investments, L.P.

Christopher Piche, Vice President of Development – The Mayer Corp

Mark Strauss, Managing Director – Cohen Financial

For more info, go to www.Crittendenconferences.com

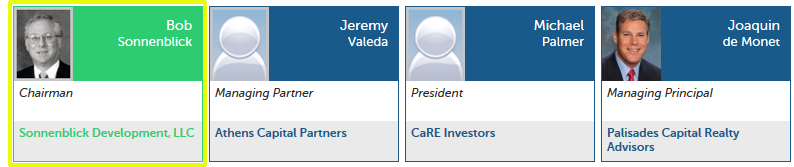

Panel Participants:

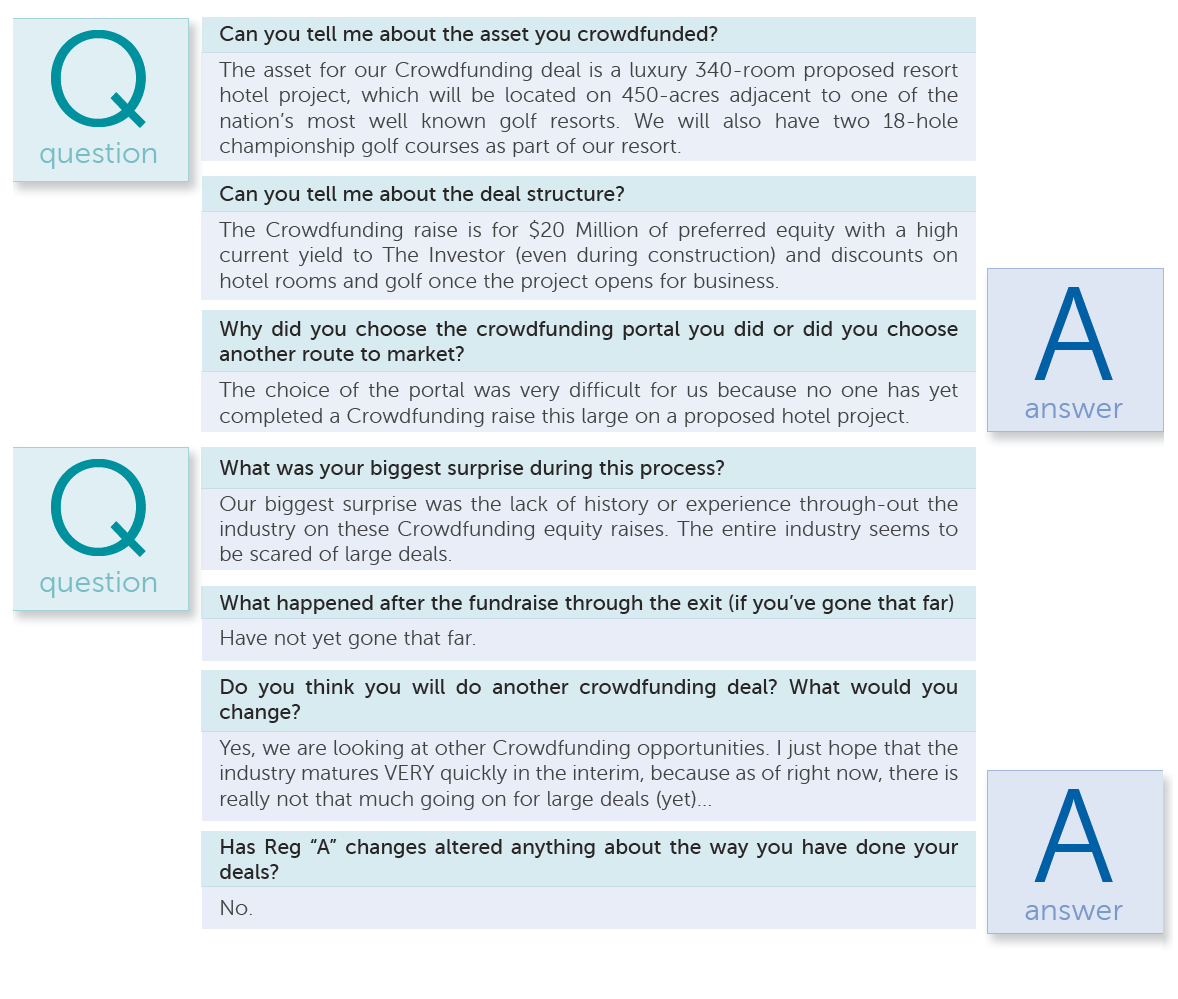

Monday, March 9th, 2015 1:45 PM The Developers Due Diligence Perspective… Comparing the Major Platforms.. Why did you Choose your Crowdfunder to Raise Capital?

By Leticia Ordaz

SACRAMENTO, Calif. (KCRA) —The Sacramento County Board of Supervisors voted 5-0 on Tuesday to approve a planned $24 million hotel at the Sacramento International Airport — and it’s expected to bring hundreds of new jobs to the region.

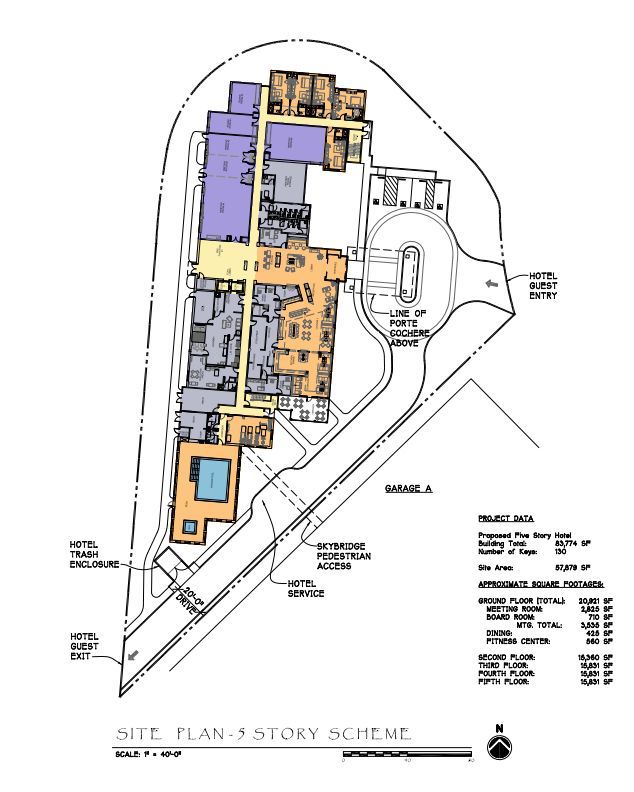

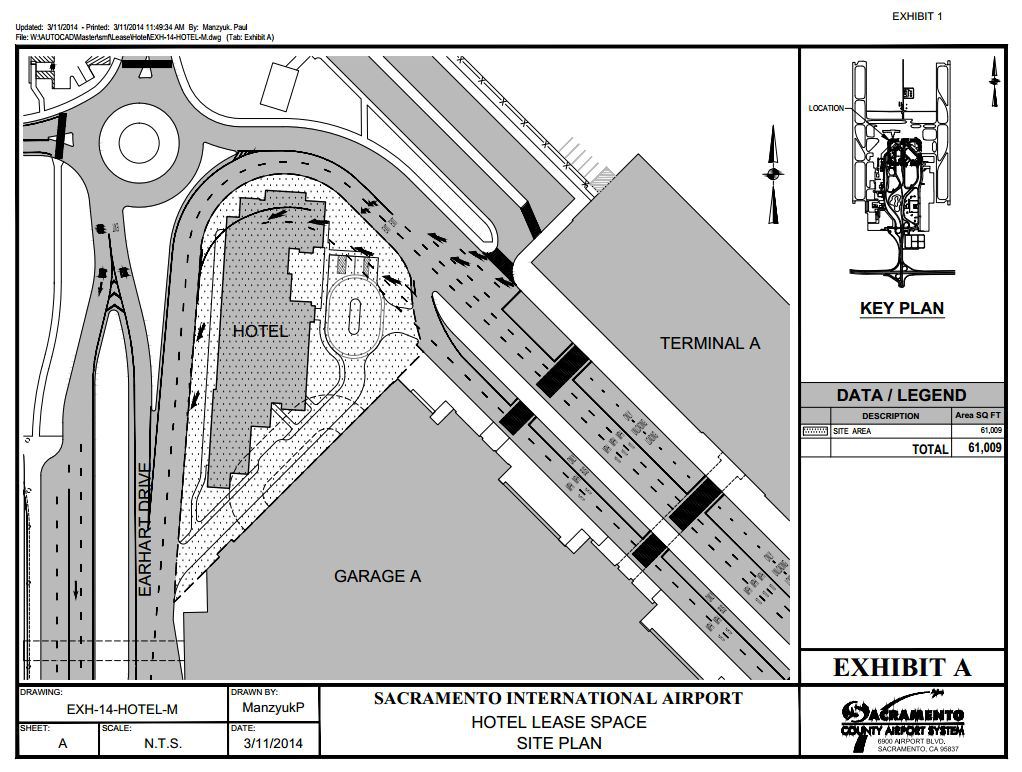

The hotel will be funded by a developer who is planning on building a five-story, 135-room Hyatt Place.

Los Angeles-based Sonnenblick Development is proposing to put a Hyatt hotel in a grassy area next to a parking garage, an open space between the airport’s two terminals.

“(It will be) very easily accessible from Terminal A and Terminal B,” said Robert Sonnenblick, with Sonneblick Development. “You fall out of baggage claim right into our lobby.”

The project will start this spring and generate about 300 construction jobs in the next two years.

Airport travelers are excited already.

“It’s a good thing for Sacramento,” Sydney Dawes said Tuesday. “Growth is great.”

Read full coverage: http://www.kcra.com/news/local-news/news-sacramento/county-set-to-vote-on-hyatt-place-at-sac-international/30945560

Monday, March 9th, 2015

Session Chair:

Monday, March 9th, 2015

Session Chair:

Panel Participants:

7:00 AM – 9:00 AM

Location

Luxe Summit Hotel Bel Air

11461 Sunset Blvd.

Los Angeles, CA. 90049

Registration

Non-Member – $75.00 (USD)

Students – $25.00 (USD)

With valid student ID

$10.00 – Onsite Fee

Southern California, especially Los Angeles County, is one of the largest Hospitality markets in the United States. A revitalized Downtown Los Angeles, with one of the nation’s largest international airports, and a diverse economy of business, entertainment, international trade, media, fashion, science, technology and education, has contributed to a strong demand for lodging. Experts look to attract as many as 4,000 additional hotel rooms over the next several years. Our distinguished panel will share their thoughts regarding recent trends and strategies for on-going and future hotel development.

24 million hotel will have 135-room capacity

By Leticia Ordaz

8:36 PM PST Jan 27, 2015

SACRAMENTO, Calif. (KCRA) —The Sacramento County Board of Supervisors voted 5-0 on Tuesday to approve a planned $24 million hotel at the Sacramento International Airport — and it’s expected to bring hundreds of new jobs to the region.

The hotel will be funded by a developer who is planning on building a five-story, 135-room Hyatt Place.

Los Angeles-based Sonnenblick Development is proposing to put a Hyatt hotel in a grassy area next to a parking garage, an open space between the airport’s two terminals.

“(It will be) very easily accessible from Terminal A and Terminal B,” said Robert Sonnenblick, with Sonneblick Development. “You fall out of baggage claim right into our lobby.”

The project will start this spring and generate about 300 construction jobs in the next two years.

“It’s a good thing for Sacramento,” Sydney Dawes said Tuesday. “Growth is great.”

An existing hotel was torn down more than six years ago to make room for the new Terminal B. The recession stopped plans for a new hotel at that time.

The economic revival doesn’t stop with the hotel.

Construction crews got an early start Tuesday morning at Bonney Field, the home of Sacramento Republic FC. The team is spending $1.6 million of its own money to expand the stadium’s seating from holding about 8,000 to now 11,000 fans at the Cal Expo site.

The project will send a strong message to Major League Soccer, a Sac Republic spokeswoman said.

“To show them that we can grow to a threshold of 11,000 — and then maybe as high as 14,000 in the future — (it) really shows that there is a demand and a market here in Sacramento,” Erika Bjork told KCRA 3.

Sacramento is among the cities in the running for MLS’s 24th and final franchise. Officials expect the league to make an announcement on expansion plans by June.

“We’re standing where we’ll probably have about 4,000 to 4,500 additional seating in the bleacher section — our most ardent and passionate supporters — our supporters including Tower Bridge Battalion,” said Bjork while showing KCRA 3 around on Tuesday.

Macy’s will also receive tax incentives to set up a warehouse at the former Campbell’s site. The online distribution center for wedding gifts and other goods will generate as many as 350 jobs.

“The warehousing jobs usually average $15 to $20 an hour, which is competitive for our area,” said Troy Givans, the Sacramento County director of economic development.

The worksite for the newly renamed Capital Commerce Center will become a magnet for new jobs.

Tony Bizjak | The Sacramento Bee | January 28, 2015 3:26pm

Jan. 27–Travelers to and from Sacramento International Airport soon will have a place to stay overnight on airport property, although not as grand as once planned.

Sacramento County supervisors Tuesday morning approved a new five-story airport business hotel, seven years after tearing down a smaller one.

The county will team with developer Sonnenblick Industries LLC to construct a 135-room Hyatt Place within walking distance of both airport terminals. The hotel will include an indoor pool and spa, fitness room, dining area and 3,500 square feet of meeting space.

Sonnenblick, a Southern California developer, has built hotels adjacent to medical facilities, but company principal Bob Sonnenblick said this is the first of what he hopes will be several airport hotels his company will develop in the next few years.

The hotel will sit on a triangle of grass adjacent to the north side of the parking garage between the airport’s two terminals. Sonnenblick and airport officials say the hotel will be a major amenity for travelers from around Northern California who want to stay overnight before an early morning flight. The hotel also likely will serve business people and those visiting the Capitol on business.

Sonnenblick said the location on airport grounds should allow his company to charge a premium room rate. He estimated an average night at the hotel would cost $150.

“The advantage we have is that the costumer does not have to get into a minivan and drive 10 to 15 minutes each way to stay at a hotel,” he said. “Our hotel, you literally walk out of baggage claim and into our front door.”

The hotel represents a success for airport officials, who are trying to add amenities and promote their facility as a premier Northern California airport. It is a comedown, though, from what airport officials planned a few years ago. Originally, the new hotel was to be a high-rise built directly on top of the new Terminal B, allowing hotel guests to go from room to plane without stepping outside. The hotel’s lobby would have opened directly onto the terminal ticketing area.

But that plan proved too costly, and was shelved during airport construction. Sonnenblick later explored the possibility of building two hotels elsewhere on airport grounds, one upscale with extensive meeting and ballroom space, the other more modest. Marketing studies, however, determined the upscale hotel would not pencil out, he said.

The proposed hotel will, however, be larger and better appointed than the former Host Airport Hotel, he said. “We are going to build this beautifully.”

The project has been delayed by a flood-related federal moratorium on most new construction in the Natomas basin. But those restrictions are expected to be removed in May or June, and Sonnenblick said his company will be ready immediately to submit project plans to the county for approval.

Sonnenblick expects to spend about $24 million building the hotel, which is expected to open in late 2017.

The developer will pay the airport a one-time fee of $2.46 million for use of 164 ground-floor spaces in the parking garage for guest parking. Sonnenblick will also pay the airport a minimum of $900,000 in total rent across the first four years: $150,000 annually in the first two years and $300,000 annually in the next two years. Thereafter, rent payments will be based on a percentage of hotel gross revenue, estimated at $475,000 in the fifth year.

Sonnenblick has told the county it intends to enter into a “labor harmony agreement” with UNITE HERE Hotel & Restaurant Employee Union Local 49 when hiring workers to operate the hotel, according to a staff report.

Call The Bee’s Tony Bizjak, (916) 321-1059. Bee editor Kevin Yamamura contributed to this report.

5-Story Hotel Approved For Sacramento International Airport

January 27, 2015 1:13 PM

SACRAMENTO (CBS13) – Work will go forward on a hotel at the Sacramento International Airport after Sacramento County supervisors approved the project today.

Sonnenblick Development LLC and the Sacramento County Dept. of Airports will build a 5-story, 135 room Hyatt Place hotel next the parking garage at the airport, county officials announced on Friday.

“Our customers have requested the convenience of an onsite hotel for many years and we are now at a point where we are ready to move forward,” said Director of Airports John Wheat said in a statement.

Officials have been looking to build a hotel at the airport since the previous airport was demolished in 2008 to make room Terminal B.

Construction could begin as early as June 2015, and the hotel would open in 2017, airport officials say.

Sonnenblick is reportedly investing $23 million to build the hotel.

BEE METRO STAFF

01/27/2015 12:00 PM 01/27/2015 1:35 PM

Sacramento County supervisors Tuesday morning approved a new five-story business hotel at Sacramento International Airport, seven years after tearing down the old facility.

Supervisors voted 5-0 to work with developer Sonnenblick Industries LLC to construct a 135-room Hyatt Place within walking distance of both airport terminals. The hotel will include an indoor pool and spa, fitness room, dining area and 3,500 square feet of meeting space.

Sonnenblick has told the county it intends to enter into a “labor harmony agreement” with UNITE HERE Hotel & Restaurant Employee Union Local 49 when hiring workers to operate the hotel, according to a staff report.

The developer will pay the airport a one-time fee of $2.46 million for use of 164 ground-floor spaces in the parking garage for guest parking. Sonnenblick will also pay the airport a minimum of $900,000 in total rent across the first four years: $150,000 annually in the first two years and $300,000 annually in the next two years. Thereafter, rent payments will be based on a percentage of hotel gross revenue, estimated at $475,000 in the fifth year.

Though they support building a new airport hotel, some supervisors were not impressed Tuesday with the first drawing of the Hyatt Place hotel, telling staff that they want to review the structure’s design in the future.

“It appears it’s a concrete block facade,” said Supervisor Roberta MacGlashan. “It needs to blend in better.”

Hotel construction is expected to take two to three years. Sonnenblick is projected to spend about $24 million building the hotel.

Bee staff writer Brad Branan contributed to this report.

Read more here: http://www.sacbee.com/news/local/article8307690.html#storylink=cpy

By Sharokina Shams 7:25 PM PST Jan 23, 2015

SACRAMENTO, Calif. (KCRA) —The Sacramento International Airport could finally have a new hotel if plans that have been years in the making are approved next week.

Sonnenblick Development, a Los Angeles-based developer, is proposing to put a Hyatt Place hotel in a grassy area next to a parking garage, an open space between the airport’s two terminals.

Watch report: Plans in the works to build hotel at Sac Int’l

An existing hotel was torn down more than six years ago to make room for the new Terminal B and the recession stopped plans for a new hotel at that time.

The new terminal, which cost roughly $1 billion, has left the airport in debt and forced budget cuts.

Wheat said a new hotel, in addition to giving travelers a convenient place to stay, would also bring in new money.

“Everything helps, I mean, it’s a revenue,” Wheat said.

The $24 million in construction costs would be paid by the developer, who would pay the airport about $2.5 million up front, and several hundred thousand dollars a year to lease the property.

On Friday, some travelers said a new hotel would make traveling more convenient for out-of-town visitors and for travelers from around Northern California.

“If you’re leaving on a long trip and have a very early departure, that might be a good idea,” said Neil Robinson, who said he lives in Folsom.

See also:

Video Transcript

INTERVIEW WITH SABRINA RODRIGUEZ RIGHT NOW ON KCRA.COM. PLANS ARE MOVING FORWARD TO BUILD A HOTEL AT SACRAMENTO INTERNATIONAL AIRPORT. IF COUNTY LEADERS APPROVE THIS PLAN, THE HOTEL WOULD BE BUILT HERE IN THIS GRASSY AREA BETWEEN TERMINAL A AND TERMINAL B. AND THE NEW HYATT PLACE HOTEL WOULD LOOK LIKE THIS. KCRA 3’S SHAROKINA SHAMS IS LIVE AT THE AIRPORT AND THESE PLANS AREN’T REALLY NEW. NOW IT LOOKS LIKE IT WILL HAPPEN. THAT’S RIGHT. THESE PLANS HAVE BEEN A LONG TIME IN THE MAKING. WE CAN TAKE A LOOK OUTSIDE OF THE WINDOWS AND GIVE YOU A LOOK AT THE SITE BEHIND ME LOOKING OUT THE WINDOWS OF THE BACK OF TERMINAL B. THE HOTEL WOULD GO WHERE THAT ART WORK SITS OUTSIDE A PARKING GARAGE. IT COULD MEAN A MUCH-NEEDED FINANCIAL BOOST FOR A COUNTY AIRPORT THAT HAS A LOT OF DEBT. DUSTIN BILTON IS VISITING SACRAMENTO TODAY WITH HIS 18-MONTH-OLD SON. NORMALLY, HE’S HERE ON BUSINESS AND LIKES THE IDEA OF A HOTEL AT SACRAMENTO INTERNATIONAL AIRPORT. FOR ME AS A MANAGER, IF I WANT TO HOST A MEETING HERE, IT GIVES ME ANOTHER OPTION, TOO. FOR ANOTHER REASON THAT WE WOULDN’T GO TO SAN FRANCISCO. IT WOULD GIVE SACRAMENTO ANOTHER OPPORTUNITY. THIS ART SHOWS WHAT HYATT IS PLANNING — A NEW, 135-ROOM HOTEL LIKE THIS HYATT PLACE HOTEL WHICH WAS BUILT IN ROSEVILLE, NEAR THUNDER VALLEY CASINO FIVE YEARS AGO. EVERYBODY’S GOING TO HAVE JOBS. IT’S KIND OF A PEBBLE IN THE WATER, IT GOES OUT FROM THERE. AN EXISTING HOTEL HERE WAS TORN DOWN SIX YEARS AGO TO MAKE ROOM FOR THE NEW TERMINAL B. WITH A COST OF $1 BILLION, THIS TERMINAL HAS ALSO BROUGHT DEBT TO THE AIRPORT AND FORCED BUDGET CUTS. BUT A NEW HOTEL, SINCE IT WOULD BE PAID FOR BY THE DEVELOPER, COULD HELP PUT A DENT IN THAT. HYATT WOULD PAY THE AIRPORT $2.5 MILLION UP FRONT AND THEN SEVERAL HUNDRED THOUSAND DOLLARS A YEAR TO LEASE THE PROPERTY. JOHN WHEAT IS THE COUNTY’S AIRPORT DIRECTOR. EVERYTHING HELPS. I MEAN, IT’S A REVENUE. IT REALLY BENEFITS THE PEOPLE WITHIN OUR PRIMARY REGION, A REGION ALL THE WAY UP TO REDDING, YOU KNOW, WITHIN 100 MILES OF THIS AIRPORT. THERE WERE PLANS FOR A NEW HOTEL AS TERMINAL B WAS GOING UP, BUT THEY WERE SCRAPPED BECAUSE OF THE RECESSION. TODAY THOUGH, IT WASN’T JUST FAR-AWAY TRAVELERS WHO TOLD US THEY’D STAY IN A HOTEL HERE. NEIL ROBINSON LIVES IN FOLSOM. IF YOU’RE LEAVING ON A LONG TRIP AND HAVE A VERY EARLY DEPARTURE, THAT MIGHT BE A GOOD IDEA. IN CASE YOU’RE CURIOUS, HYATT IS SET TO SPEND $24 MILLION BUILDING THE HOTEL. THIS ISN’T A DONE DEAL UNTIL THE COUNTY BOARD OF SUPERVISORS APPROVES IT. THEY’RE SET TO CONSIDER IT AT THEIR MEETING NEXT WEEK.

Mark Anderson

Staff Writer- Sacramento Business Journal

A $23 million Hyatt Place hotel proposed for Sacramento International Airport could be open in 2017.

This rendering depicts a Hyatt Place hotel proposed for Sacramento International Airport. It could be open in 2017, if Sacramento County approves a development agreement.

Shimahara Illustration

Sacramento County supervisors at their meeting Tuesday will consider a development agreement with Los Angeles-based real estate development firm Sonnenblick Development LLC to build a 135-room hotel between the airport’s main commercial terminals. The hotel would feature indoor pool and spa, fitness room, a dining area and 3,500 square feet of meeting space.

Hospitality company Sonnenblick-SMF LLC would develop and operate the hotel, paying the county a fixed fee of $900,000 though the first four years of operations, and then a percentage of gross revenue. That scale would be 5 percent from years five through 19, 6 percent in years 20 through 39 and then 7 percent of gross in years 40 through 50.

The developer also would pay a one-time fee of $2.5 million to use 164 spaces in the airport’s parking garage.

“Our customers have requested the convenience of an onsite hotel for many years and we are now at a point where we are ready to move forward,” said Sacramento County Airport System director John Wheat.

If approved, construction could begin by June, when federal flood map building restrictions on the Natomas Basin are lifted.

A $23 million Hyatt Place hotel proposed for Sacramento International Airport could be open in 2017, if Sacramento County approves a development agreement. This is the site.

Sacramento County Department of Airports

Hyatt Place is a limited-service property. Locally, there are Hyatt Place properties in Davis, Rancho Cordova and Roseville.

Sacramento County, which operates the airport, has been seeking a hotel for more than a decade. The previous hotel at the airport, the Host Airport Hotel, was successful, but the small hotel was demolished for the expansion of the airport’s new terminal and parking garage.

Sonnenblick-SMF LLC would negotiate a contract with the UNITE-HERE Local 49, the local hotel and restaurant employees union. The previous hotel had been a union shop.

The county says if the Hyatt Place is successful, a second hotel is possible.

The airport is a demand driver for the hotel. Many flights out of Sacramento leave very early in the morning, so travelers from all over Northern California could use the hotel to arrive the night before traveling. Also, the hotel, like the airport, is right off Interstate 5, which can generate demand from drivers. Another potential business for the hotel is air crew rooms. Many airlines have contracts that require them house their flight crews in nearby hotels.

January 23, 2015 1:52 PM

SACRAMENTO (CBS13) – A Los Angeles developer is looking to build a hotel at the Sacramento International Airport, county officials announced Friday.

Airport officials will be meeting the Sacramento County Board of Supervisors come Tuesday for approval of the plan. Sonnenblick Development LLC and the Sacramento County Dept. of Airports reportedly have an agreement to build a 5-story, 135 room Hyatt Place hotel next the parking garage at the airport.

“Our customers have requested the convenience of an onsite hotel for many years and we are now at a point where we are ready to move forward,” said Director of Airports John Wheat in a release.

Officials have been looking to build a hotel at the airport since Host Hotel was demolished in 2008 to make room Terminal B.

If the new hotel plan is approved, construction could begin as early as June 2015 and the hotel would open in 2017, airport officials say.

Sonnenblick is reportedly investing $23 million to build the hotel.

January 24, 2015 by bboyd Leave a Comment

THE NATOMAS BUZZ | @natomasbuzz

The Sacramento County Board of Supervisors will decide Tuesday whether to approve an agreement that will allow a five-story hotel to be built at the Sacramento International Airport.

The Sacramento County Department of Airports will go before the board on Jan. 27 to request approval of an agreement with a developer to build a long-sought onsite hotel at the airport. The Sacramento County Department of Airports is responsible for planning, developing, operating and maintaining the county’s four airports: Sacramento International Airport, Executive Airport, Mather Airport and Franklin Field.

Sonnenblick Development LLC has proposed building five-story, 135-room Hyatt Place hotel with an indoor pool and spa, fitness room, dining area and 3,500 square feet of meeting space.

The Los Angeles-based developer plans to lease a 1.4-acre site adjacent to the parking garage for construction of the hotel, as well as 164 spaces on the ground level of the garage. The hotel would be accessible to passengers of both terminals.

Construction could begin as early as June 2015, when federal building restrictions on the Natomas Basin are expected to be lifted. In that scenario, the hotel would open in 2017 or 2018.

Sonnenblick has agreed to invest at least $23 million to build the facility. The Department of Airports will receive a one-time payment of $2.46 million for the use of the parking garage spaces. Rent for the hotel site will be fixed for the first four years for an amount totaling $900,000. In subsequent years, rent will be paid as a percentage of gross revenue.

An in-terminal hotel was in the works for the new Terminal B but was removed from plans due to the economic downturn. Airport staff performed a site analysis and in 2011 issued a Request for Proposals for hotel development. Sonnenblick responded to the RFP with a proposal to develop two hotels. If the Hyatt Place is successful, a second hotel is a possibility.

The onsite Host Hotel was demolished in 2008 to make room for Terminal B construction. Under the agreement going to county supervisors this week, Sonnenblick LLC would pay for construction and assume the financial risk associated with owning and operating the hotel.

The item is number 51 on the agenda and is scheduled for 10:45 a.m. Tuesday. Click here for more information

– See more at: http://www.natomasbuzz.com/2015/01/airport-seeks-approval-for-five-story-hotel/

Posted 12:32 PM, January 23, 2015, by Sam Cohen, Updated at 12:37pm, January 23, 2015

Sacramento International Airport is seeking approval for plans to build a five-story, 135-room hotel onsite.

A Los Angeles-based developer is proposing to build a Hyatt Place hotel near the parking garage, with access to both terminals. Plans include an indoor pool and spa, fitness room, dining area and 3,500 square foot meeting space.

The Sacramento County Department of Airports will take their plan to the Board of Supervisors on Tuesday.

If approved, construction could begin this summer when building restrictions in the Natomas area are expected to be lifted. It could take more than a year to build the hotel.

An onsite hotel was demolished almost six years ago to make room for the new Terminal B. The new plans have the developer,

This rendering depicts a Hyatt Place hotel proposed for Sacramento International Airport. It could be open in 2017, if Sacramento County approves a development agreement.Shimahara Illustration

By Tony Bizjak tbizjak@sacbee.com

01/23/2015 9:31 PM

Seven years after tearing down the old airport hotel, Sacramento International Airport has reached a deal with a private developer to build a new facility on site – a five-story hotel that will sit within short walking distance of both passenger terminals.

The deal, years in the making, will provide airport customers with a privately built 135-room Hyatt Place. The hotel will include an indoor pool and spa, fitness room, dining area and 3,500 square feet of meeting space.

Airport director John Wheat called the hotel deal a double bonus, returning a major passenger amenity to airport grounds and providing a needed income boost. Airport officials have sought ways to boost revenue to pay down a $1 billion debt load from the recent construction of a new terminal and passenger concourse building.

“It is definitely a nice convenience to our passengers,” Wheat said. “We look at it as a customer service. And, secondly, it generates additional revenue to the airport system.”

The developer, Sonnenblick Industries LLC of Southern California, has been negotiating for two years with the county on the deal. Sonnenblick , the sole company to respond to the airport’s request for proposals, specializes in government buildings but has built a number of hotels and increased its hotel development in recent years.

The airport tore down the previous on-site hotel in 2008 to make room for Terminal B. Officials had originally planned to build a new hotel several years ago as part of the Terminal B expansion project, but were forced to eliminate it as a cost-saving move during the recession.

Until recently, the airport and other Natomas-area landowners have been unable to build new structures because of a de facto building moratorium until flood improvement funding was authorized. That moratorium appears ready to be lifted this spring or summer.

Airport officials will present the deal to the county Board of Supervisors on Tuesday for approval.

According to a staff report for that meeting, Sonnenblick will build the hotel on a 1.4-acre site it will lease from the airport next to the parking garage. The developer will pay the airport a one-time fee of $2.46 million to use 164 ground-floor spaces in the garage for guest parking.

The company also will pay the airport an annual $900,000 in rent for the first four years. In year five and beyond, the rent will be set at a percentage of hotel gross revenue, estimated to be about $475,000 in year five.

The hotel construction cost, to be borne by Sonnenblick, is expected to be about $24 million. Construction is expected to take two to three years.

The hotel site will be on a triangular grassy area, currently unused, at the north end of the parking garage.

Call The Bee’s Tony Bizjak, (916) 321-1059.

Jan 23, 2015, 7:25am PST

Mark Anderson Staff Writer- Sacramento Business Journal

Todd Quam | Digital Sky Aerial Imaging

In a major step forward for Sacramento International Airport, county supervisors on Tuesday will consider a development agreement for a 135-room Hyatt Place hotel to be built between the two passenger terminals.

In a major step forward for Sacramento International Airport, county supervisors on Tuesday will consider a development agreement for a 135-room Hyatt Place hotel to be built between the two passenger terminals.

Sacramento County, which operates the airport, has been seeking a hotel for more than a decade. The previous hotel at the airport, the Host Airport Hotel, was successful, but the small hotel was demolished for the expansion of the airport’s new terminal and parking garage.

The five-story hotel would be just north of new parking structure at the airport, between the two commercial airline terminals.

Hospitality company Sonnenblick-SMF LLC would develop and operate the hotel, paying the county a fixed fee of $900,000 though the first four years of operations, and then a scale of percentage of gross revenue. That scale would be 5 percent from years five through 19, 6 percent in years 20 through 39 and then 7 percent of gross in years 40 through 50.

Hyatt Place is a limited-service property. Locally, there are Hyatt Place properties in Davis, Rancho Cordova and Roseville.

Sonnenblick-SMF LLC would negotiate a contract with the UNITE-HERE Local 49, the local hotel and restaurant employees union. The previous hotel had been a union shop.

The 2nd Annual Boutique Hotel Investment Conference BLLA held in New York 2014

Bob Sonnenblick Moderating: New York Boutique Hotel Investment Conference.

November 21 2014 Speakers at the Caribbean Hotel Investment Conference & Operations Summit lament a lack of financing that has created a dearth of deals, but they don’t expect it to last forever.

By Jeff Higley

Editorial Director

jeff@hotelnewsnow.com

The biggest issue is easy to spot, panelists said. Despite strong performance fundamentals for the region’s hotel industry, lenders are reluctant—and in a number of cases unable—to throw their hats in the ring when it comes to deals.

“The performance numbers aren’t translating into the availability of capital,” said Gary Brough, managing director of KPMG, during the “Capital and the new normal” general session.

“Right now there is a ton of money going into the hotel business in the (U.S),” said Bob Sonnenblick, principal of Sonnenblick Development. “It’s going to take time to trickle down here.”

Adam Rosenberg (right) of Fortress Investment Group and Gary Brough (center) of KPMG react to a comment from Bob Sonnenblick of Sonnenblick Development during the -Capital and the New Normal- session at last week’s Caribbean Hotel Investment Conference – Operations Summit. (Photo: Jeff Higley) –

“The good and the bad of the region is oftentimes the absence of senior debt, or if there is senior debt you’re talking about 50% equity,” added Nick Hecker, senior principal at Och-Ziff Real Estate.

Bill Sipple, executive managing director of HVS Capital Corporation, said it’s difficult to source capital for the Caribbean, but cracks in the armor are starting to appear. He said one bright spot is U.S. commercial mortgage-backed securities lenders, which are starting to show an interest in the region.

“They’re seeking ways of finding new avenues that are less competitive and where they can get higher yields,” Sipple said.

Lorne Bassel, president and CEO of Crave Real Estate, said during the “Investor/capital provider outlook” general session that investors who have a clear intent to stay in the deal for the long run are more apt to obtain financing.

“(Lenders) want to see a compelling vision in the plan that makes your project different,” Bassel said. “Marina, golf and beach just isn’t enough. They want to see you bought in financially for the next 10 years.”

But Ali Elam, managing director of Fortress Investment Group, said there’s a simple reason large banks aren’t lending into the Caribbean: “They simply do not have the facility to make loans in the Caribbean. It’s not something they invested in infrastructure for.”

Another issue is rating agencies don’t have coverage in all 32 countries in the Caribbean, Elam said.

The obvious lack of capital creates a shallow deal environment in the region.

George Spence, principal of Leading Property Group, said while some deals have been completed during the past 18 months, it’s going to take at least that long for the flow to increase.

“The Caribbean is 18 to 24 months behind the U.S. in terms of capital and new deals going on,” he said.

Spence noted several key transactions in the Caribbean during 2013 and 2014, including the former Ritz-Carlton Rose Hall in Jamaica that sold to Playa Hotels & Resorts for $70 million and rebranded as the Hyatt Zilara Beach, and the 105-room One & Only Ocean Club in the Bahamas that was sold to Access Industries for a reported $1 million per room.

Interest is building

There is growing interest in acquiring hotels in the region from players such as Fortress Investment, according to managing director Adam Rosenberg. But a deal would have to meet certain criteria for the company to make an acquisition.

“There’s a paradox,” Rosenberg said. “The world seems awash in capital … yet it’s very hard to find a deal from a return perspective. It’s hard to find things that are the right fit. (The Caribbean is) off the radar for a lot of capital providers.”

Sipple said the appetite for projects in the Caribbean tend to be in the $30-million to $100-million range.

“It doesn’t have to be a mega deal to get interest,” Sipple said. “There’s a lot of non-resort type of properties that can be built here. There’s a need for them.”

“If you’re going to spend the time to put capital out, you might as well do a large project,” Sonnenblick said, acknowledging that select- and limited-service properties have a place at airports in the region.

Elam said Fortress’ acquisition of the debt on the Westin Grand Cayman Seven Mile Beach Resort and its refinancing of the Aruba Marriott Resort is proof the company thinks the recovery in the Caribbean will continue. The two deals combined equated to a $470-million investment he said.

“Investment in the Caribbean will always be a deep pocketed investment game, knowing that eventually you’ll have an investment that’s unique,” Elam said.

Help from governments go a long way

Panelists agreed that some of that investment should be offset by governments that want to attract development and capital infusion into their countries.

A prime example of that is the Dorado Beach, A Ritz-Carlton Reserve, in Puerto Rico, according to Kenny Blatt, principal and COO for CPG Real Estate, which owns the property.

“Government participation allowed us to slog through three or four tough years,” Blatt said during the “Hospitality Leaders Outlook” panel.

The $1,200 to $1,300 average daily rate for the property has given CPG reason to develop the other 1,400 acres of land around the project, according to Blatt. The company refinanced Dorado Beach on Wednesday with Och-Ziff providing the financing.

“It gives us liquidity to build real estate, including hopefully building a second hotel site,” Blatt said.

The effects an active government can have on resort development and transactions aren’t always visible, speakers said.

“When people talk about cash flows and returns on a project, the first question I have is always, ‘What is the tax impact?’” Hecker said.

There’s also a difference between strategic investment and economic investment in the Caribbean, panelists said.

“The most strategic investor is generally the government,” Sonnenblick said. “I’m surprised there isn’t more going on in the Caribbean where the government is doing more.”

John Keith, managing director for Caribe Hospitality, said policies of some of the Caribbean governments, especially the foreign exchange rates, make it difficult for the hotel industry to be successful.

“I would challenge the governments to review their policy,” he said, adding they must understand they are competing in a world full of alternatives.

November 14, 2014

Bob Sonnenblick panelist at Hotel Summit on November 11th, 2014 in Los Angeles

Sonnenblick Development principal Bob Sonnenblick, a panelist, says LA just finished its best 12 months ever in total volume of hotel bookings and tourism, and supply is under control. In general, the coasts are very strong but the middle of the country is still fairly flat. He’s 100% concentrated on new development, but his biggest problem is that there is no land left in LA. (It’s why Katy Perry is always Walkin’ on Air.)

Rich says he’s seeing a lot of deals for limited and select-service hotels, and fewer full-service ones being built. Bob says the former have a higher profit margin because you don’t have a big spa, room service or gobs of meeting space. “It’s a rooms-only box.” Brian says the debt and equity markets love limited service because they view it as less risky. For his San Francisco project, he cobbled together EB-5 financing, historic and New Market tax credits, and a low-leverage senior construction loan.

11:15 A.M. TO 12:15 P.M. – GENERAL SESSION: CAPITAL AND THE NEW NORMAL: Panel of capital providers and advisers discuss investments in the Caribbean and what it takes to get a deal done. Who is financing projects in the Caribbean and on what basis? While it appears that confidence in the region

amongst financiers is improving this does not appear to be translating into readily available capital. Funding has been scarce for so long that it appears as if the landscape may have changed permanently. Does this environment represent the “new normal”? If so what does the new normal look like? How are

deals currently being structured? What are the key terms and conditions? Who are we dealing with and how sustainable are their interest in the region? The ability to raise capital is going to be absolutely critical if, as appears to be the case, the region is over the worst of the economic cr isis and we can start

to look forward to the future with cautious optimism. Help us resolve this crucial issue by participating in an interactive discussion with our panel of innovative and imaginative financiers bringing a fresh approach to a difficult and complex problem.

Moderator: Gary Brough, Managing Director- KPMG

Panelists:

Nicholas Hecker, Senior Principal – Och Ziff Real Estate

Bill Sipple, Executive Managing Director – HVS Capital Corp

Bob Sonnenblick, Principal-Sonnenblick Development LLC

Adam Rosenberg, Global Head of Gaming & Leisure- Fortress Investment Group-Credit Funds

![]()

Los Angeles Hotel

Oct 31, 2014

Sonnenblick Development principal Bob Sonnenblick

This morning, Sonnenblick Development principal Bob Sonnenblick (in full Halloween mode before trick-or-treating with his kids in Pacific Palisades) told us about his newest resort hotel project: Chambers Bay Resort in University Place, WA, a 30-minute drive from Sea-Tac Airport. What’s key for Bob, an avid golfer, is that next June, it’s going to be the home course of the 2015 US Open, where it will be seen by 300 million people on TV. Bob’s building a 320-room luxury hotel with a 40k SF conference center and a 10k SF spa, with a second golf course that will front directly on Puget Sound. The new course is being designed by the famed Robert Trent Jones Jr.

Bob says Chambers Bay is a $125M project. The hotel will be raised, so that people can look through the glass on the first floor and still enjoy the views (including the snow-capped peaks of the Olympic Mountains). He’s also working on a hotel site in the hot market of downtown Beverly Hills. Bob just got back from the best vacation of his life: two weeks in Phuket, Thailand.

Read on BISNOW

Los Angeles

| Los Angeles 11.07.2014 |

| LA HOTEL BOOM! A RACE TO THE TOP |

|

Jay Newman Clare de Briere Bob Sonnenblick |

| — Fri Nov 07, 2014. Millennium Biltmore Hotel Los Angeles — |

![]()

Jay Newman

COO

Athens Group

Clare de Briere

COO

The Ratkovich Company

Bob Sonnenblick

Principal

Sonnenblick

|

8:00-8:30 AM

|

Continental Breakfast & Networking | |||

| 8:30-10:30 AM | All-Star Panelists | |||

|

10:30-11:00 AM

|

Post-Panel Networking |

Please join Bisnow for a great morning of top speakers and networking with members of the Los Angeles hotel investment community. We’ll cover how deals are getting done and what the outlook is for financing and development in the coming year.

Please join Bisnow for a great morning of top speakers and networking with members of the Los Angeles hotel investment community. We’ll cover how deals are getting done and what the outlook is for financing and development in the coming year.

(Gold Ballroom, Lobby Level) 506 South Grand Avenue Los Angeles, CA, 90071

Parking: $10 self, $22 valet

MORE INFORMATION!

September 29, 2014

The ground floor would be all glass so people walking onto the property can enjoy the views.

Robert Sonnenblick is the man who wants to build a $150 million resort at Chambers Bay, and he says as soon as he saw the location it was love at first sight.

“That site at Chambers Bay, on a scale of one to 10, is a 12,” said the Los Angeles-based developer. He plans to build a 258-room hotel, conference center and second golf course at the site in University Place where the U.S. Open will be played next June.

“To me, I’m shocked that no one built a hotel prior to me getting involved,” Sonnenblick said. “I fell in love with it the instant I walked onto the property.”

Sonnenblick is chairman of Sonnenblick Development, which was formed in 2011 to specialize in four-star oceanfront resort hotels across the country, with a focus on high-end golf resorts.

Sonnenblick heard about Chambers Bay about a year and half ago while working on a golf course and hotel development near Pinehurst Resort in North Carolina. Someone with the United States Golf Association told him Chambers Bay is hosting the 2015 U.S. Open and there weren’t any hotels near the golf course.

Sonnenblick was in Seattle for a business trip and decided to visit the golf course, which is owned by Pierce County. He said he stopped dead in his tracks when he set foot on the property, awed by the sweeping views of Puget Sound and the Olympics. He called it the best site for a hotel he has ever seen.

Part of Sonnenblick’s plan is to convert Pierce County’s award-winning Environmental Services Building into a 48,000-square-foot conference center and add a ballroom for weddings. The Environmental Services Building was designed by The Miller Hull Partnership.

“To have that already on the property is something that we’re thrilled with,” he said.

Pierce County is planning to build a new headquarters on the campus of the former Puget Sound Hospital and consolidate a third of its 3,000 employees. Officials say it’s too soon to say where employees now housed in the Environmental Services Building would go.

Construction of the county’s new headquarters could begin early next year. The county has picked a team headed by Wright Runstad Associates, with NBBJ Architects, Gunsul + Iverson Architects and Howard S. Wright. The headquarters could open by mid-2016.

More walking paths and biking trails would be built on the property to appeal to locals

Sonnenblick is big on views, and they are plentiful at Chambers Bay.

The new hotel will be raised about 22 feet in the air and the ground floor will be all glass so people walking onto the property can enjoy the views.

The hotel will have two restaurants and two bars. Sonnenblick said one of the bars will be like the “19th hole” found at most golf courses.

Adding a second golf course is an important part of the plan. Sonnenblick said the existing course is fescue grass and golf carts aren’t allowed, so it’s a walk-only course — and that doesn’t work with a hotel.

“The reason we need a second course is the normal tourist golfer does not walk,” he said.

Golfers will likely have better scores on the second course because it will have wider fairways and a more forgiving layout.

Sonnenblick also said he wants a “huge” increase in the number of walking paths and biking trails on the property to appeal to locals.

Sonnenblick said the plan is to offer discounts on rooms, food and beverages to people from University Place, Lakewood and Steilacoom.

His team just finished architectural renderings for the project and hopes to start construction next year.

“I want to start the day the U.S. Open finishes next June,” he said. “I don’t think the county or the city will be ready for us to start by then, so it will probably be a couple of months after that.”

Sonnenblick said the U.S. Open will generate tremendous publicity for his project before it even opens because Chambers Bay will be on the cover of golf magazines and featured on golf shows, just like Pinehurst was earlier this year.

Sonnenblick said he wants to build the hotel and golf course simultaneously and hopes to open both in mid-2017. He said the entire project will be privately funded.

The golf course design should be finished in about a month by architect Robert Trent Jones Jr., who also designed the original Chambers Bay Golf Course.

Other team members are: the Los Angeles office of Harley Ellis Devereaux, architect; Absher Construction of Puyallup, general contractor; KPFF of Tacoma, civil engineer; PCS Structural Solutions of Tacoma, structural engineer; and Transpo Group of Kirkland, traffic consultant.

(Editor’s note: This article was changed to reflect that PCS Structural Solutions is the structural engineer, and that the county hasn’t decided where to relocate its workers at the Environmental Services Building.)

Sonnenblick said he expects to hire a lot of local subcontractors.

This is Sonnenblick’s first project in Washington state, but not his first business venture here. He has financed several projects here over the years, including a $165 million construction loan and $35 million equity joint venture in the mid-1980s for Herman Sarkowsky’s AT&T Gateway Tower (now Seattle Municipal Tower).

Sonnenblick said several local companies have approached him about doing other projects since word got out about Chambers Bay. He said he is open to sites with views and waterfront access, but first wants to get the ball rolling on this one.

By Steve Maynard

Staff writer September 23, 2014

A Los Angeles developer unveiled drawings Tuesday for a resort at Chambers Bay in University Place that would be big and dramatic with a five-story hotel and sweeping views of Chambers Bay Golf Course and a proposed second course.

Click for Chambers Bay Resort Brochure

Chambers Bay Resort would consist of the 258-room hotel, a conference center, a 180-seat cafe and restaurant, and a swimming pool. The conference center would be located in what is now the county’s environmental services building, with a ballroom added on.

Pierce County Council members saw the architectural renderings for developer Bob Sonnenblick’s project for the first time Tuesday.

“That is the public’s property,” Ladenburg said. Those public amenities include the trails, parks and playground as well as the golf course where the 2015 U.S. Open will be played.

Her husband, John Ladenburg, was the county executive who spearheaded developing the former gravel mine into a championship golf course in 2007.

“To make sure that (citizens) still feel that that’s their property, I think, is very key with any development that we do out there,” said Connie Ladenburg, whose district includes University Place.

“We totally agree,” said county Executive Pat McCarthy. “Any place you put anything on this property is going to impact something. But the fact of the matter is we do have a philosophy that it does need to have good public access.”

County-owned Chambers Bay Golf Course will host the U.S. Open June 15-21 of next year. The resort hotel proposal is many months away from a final decision and would not interfere with the golf championship.

Deputy County Executive Kevin Phelps said it will take up to 18 months to update the master site plan, which would require approval by the County Council and the City Councils for both University Place and Lakewood.

The County Council likely would have to authorize the county executive to enter into an agreement with Sonnenblick.

Sonnenblick started a second 90-day extension granted by McCarthy for planning the project last week.

Phelps said Sonnenblick will have to propose financing that meets the county’s needs. The master site plan must be modified, and Sonnenblick must determine if he can fit in a second golf course.

Sonnenblick, chairman of Sonnenblick Development, said his $150 million project will enhance public access to Chambers Creek Regional Park.

“I am designing the hotel to increase public access,” Sonnenblick said in a phone interview Tuesday. “We are going to add a huge number of walking and biking trails.”

He said the project’s lower levels would be lifted up and lined with glass so that visitors could see the Puget Sound and the Olympic Mountains.

“We’re very excited about the project, and we designed it based on the input from a lot of local groups,” he said.

“We’re very excited about the project, and we designed it based on the input from a lot of local groups,” he said.

Sonnenblick hired Robert Trent Jones Jr.’s company to design the second golf course. Jones also designed the original Chambers Bay Golf Course.

Hole routings for the second course are expected to be completed in about three weeks, Sonnenblick said.

A second 18-hole course where golfers could ride carts is crucial for attracting older, higher-income customers to the resort, Sonnenblick said. Chambers Bay prohibits carts to prevent damage to fescue grass on the links-style course.

Sonnenblick met with University Place planners last month to ask questions of city planning staff as it related to his proposed development.

The City of University Place is waiting to see more detailed information about how the site will be developed, including plans for the second 18-hole golf course.

“We’ve only seen renderings of the hotel, we haven’t seen any maps or site plans,” UP City Manager Steve Sugg said Tuesday. “It’s our practice that we don’t react to renderings.”

But Sugg did say the city is interested in the project.

“The idea of a destination golf resort in UP is certainly appealing, but the details will have to be worked out,” he said.

Sonnenblick’s plan describes the hotel as reaching 66 feet, which is taller than the city’s current zoning allows. That is one of the issues that would have to be addressed through the site plan amendment process, Sugg said.

“We’ll let the process determine the outcome,” he said.

The only two council members to offer feedback were Connie Ladenburg, D-Tacoma, and Stan Flemming, R-Gig Harbor. Both voiced concerns about whether public access would be maintained.

Read more here: http://www.thenewstribune.com###

LA-based real estate developer Bob Sonnenblick, Chairman of Sonnenblick Development LLC, has been chosen to lead the Government Tenant Development Panel at the upcoming NFDA Government Real Estate Conference in Sacramento on October 1, 2014.

The Conference, the first of its kind on the West Coast, focuses on all aspects of Government-tenanted real estate projects from development, financing, management, procurement, sales, and leasing.

Please join regional leaders for the first Western Regional NFOA (National Federal Development Association | www.ndfa.us) conference on October 1, 2014 at the Sutter Club, Sacramento.

We believe this to be the first conference of its kind In the region, that is, all matters relating to government -leased and occupied real estate.

You may register at:http://nfda.ustconferenceinfo.html#westconference2014

You are also invited to sponsor the event as we believe your endorsement of the conference will prove to be beneficial t o your organizational as well as the participants attending the conference due to the unique nature of this particular conference. Sponsorships are $500.00. Your logo will appear in all our promotional materials with a link to your website, invitations & announcements on the NFDA website event page, banner at the event, program at the event as well as in the audio visual displays.

Should you have any questions, please call Greg Margetich at 916.208.2500 or email at events@themargetichgtoup.com

November 20 11:45AM – 12:35PM

(St. Clair Salons)

Hear from statewide experts about Investment, Capital Market, Industrial, Office, Multifamily and Retail Trends affecting California and Western Region

The agenda includes 40 senior level panelist, 7 high level sessions, 5 hours of networking, 2 networking receptions and endless opportunities to connect with friends in a peer to peer networking environment. There is still time to close more business in 2014

Top industry leaders have confirmed to speak at the event and the entire industry is planning their schedule and calendars to be in Los Angeles to participate in the industry’s leading regional event. This conference is designed to identify opportunities, create relationships & close business. The agenda for InterFace California Trends will examine both Macro and Micro commercial real estate trends affecting California and the Western region.

Topics to be discussed include:

|

|

|

|

|

Bob Sonnenblick |

Noel |

Marty Pupil |

Jeff Rinkov |

11:15 – 12:30

11:15 – 12:30

CONCURRENT THINK TANKS

T-3: Essentials to Meeting Lender Requirements

The discussion will focus on which lenders and mezzanine providers are the most active sources of capital in the hotel industry marketplace today and how you can expedite the loan application process by knowing what underwriters look for and the documentation that you should provide including historical rates and occupancy, property condition, standard reporting, operating statements, appraisal analysis, brand affiliation, and completed and planned upgrades.

MODERATOR:

Bob Sonnenblick, Chairman, Sonnenblick Development LLC

PANELISTS:

Peter Berk, President, PMZ Realty Capital LLC – Hotel Finance Group

Mark Laport, President & CEO, Concord Hospitality Enterprises Company

Barbara Morrison, President & CEO, TMC Financing

Mehul “Mike” Patel, CEO & Chairman, NewcrestImage

Christopher Williams, Vice President, Franchise Finance, GE Capital, Franchise Finance

Bob Sonnenblick to moderate the “Luxury Hotels & Resorts” panel at the Thinc Hotel Conference in Bali, Indonesia on Sept 5th at the Sofitel Bali Hotel.

| 4:10PM – 5:00 PM | Luxe in Flux: The Next Big Trends in Luxury Hotels and ResortsWhat lies ahead for this segment and is it a profitable business model to invest in? What are the popular and upcoming trends in in the Luxury hotel/resort segment?

|

In Focus: Washington, DC

In Focus: Washington, DCIn one of the highlight sessions at the Tourism, Hotel Investment & Networking Conference (THINC) Indonesia 2014, Robert (Bob) Sonnenblick, Chairman – Sonnenblick Development, will lead a panel discussion comprising some of the most prominent players in the region’s Luxury Hotel and Resort segment. The session, titled ‘Luxe in Flux: The Next Big Trends in Luxury Hotels and Resorts’, will see this select panel of industry experts share their perspectives and knowledge of the market, discuss latest trends, and what lies ahead for this segment in the years to come.

Justin Yang

Justin YangThe Beverly Hills hotel market, which boasts some of the highest room rates in the region but has not seen a new property built in nearly six years, is starting to heat up.

In what one city official conceded was an unusual overture, Pacific Palisades developer Sonnenblick Development has submitted an unsolicited proposal to build a 124-room luxury Auberge Resorts hotel on a 1.4 acre city-owned property at 9268 Third St.

The hotel, right in the backyard of another luxury hotel, L’Ermitage Beverly Hills, would be built on land leased from the city. The parcel now houses a small office building that has been the home of Lakeshore Entertainment since 2005.

In response to the proposal, the City Council directed staff to hold an informal public meeting last month to gauge public interest and advise the council on next steps.

While unsolicited proposals are not common, David Lightner, deputy city manager, said Beverly Hills had received expressions of interest recently for other city-owned properties, including a 5-acre site nearby on Foothill Road between Third and Alder streets.

“These proposals are not frequent,” Lightner said. “During the recession years, it was fairly unlikely. As the city emerged from recession starting from 2012, developers started looking at the (Lakeshore) site.”

Robert Sonnenblick, principal of the development firm, said in an email to the Business Journal that he was interested in the Lakeshore site because its quiet neighborhood can attract a high-end clientele, pointing to L’Ermitage’s success. He approached the city because it could give him a better deal than other privately owned sites in Beverly Hills. Land is scarce and difficult to find in the city.

“First, we really like the hotel market in Beverly Hills. It’s really strong and it has a great history,” he wrote. “Second, all of the other sites are being bid up to crazy prices by condo developers.”

That has residents wondering if the city is getting a good deal if it were to move forward with the hotel.

Marilyn Gallup, vice president of community group Beverly Hills Municipal League, said the city needs to determine a true value for the site before showing interest in projects like this.

“Looking at the renderings, it looked very nice. I’m not for it or against it,” Gallup said of the proposal. “First you have to put value on the land to know whether or not the city would be getting a good return. The city needs to decide what they want to do with the properties before you start looking at individual projects.”

That, said Lightner, is exactly what the city is doing.

“Is this the highest and best economic generator for the city? Are there other municipal functions? Are there other functions anticipated?” he asked. “That’s why the City Council said, ‘Let’s go talk to people and figure it out.’”

Healthy market

A recent report by PKF Consulting USA estimated that Beverly Hills had an average room rate of $414 and market occupancy rate of 77.3 percent last year.

Sonnenblick said a hotel on the site could generate as much as $2.5 million a year in transient occupancy taxes in addition to its payments on the ground lease.

Lightner said revenue generated by a hotel could be significant, but the city was still researching potential returns.

The last hotel to be built in Beverly Hills was the Montage, at 225 N. Canon Drive, which bowed in late 2008, and the prospect of another hotel in the city, whether an Auberge or another operator, remains preliminary. The Lakeshore site, just north of Burton Way and about four blocks west of the Four Seasons Hotel on Doheny Drive, would need to be rezoned to accommodate a hotel. Lightner said the property is zoned for parking, institutions and parks; rezoning the property would be a lengthy process requiring further studies and examinations of the site.

Lakeshore has a lease that runs for another year with an option for a five-year renewal. Lightner said the city could end that lease if the site were to be redeveloped.

Sonnenblick is not the only one to express interest in redeveloping the site as a hotel. Lightner said the owners of L’Ermitage, which fronts on Burton and backs on the Lakeshore site, has also expressed interest. A spokeswoman for L’Ermitage declined to comment.

Alan X. Reay of Irvine hospitality consultancy Atlas Hospitality Group said there is more than enough room for Beverly Hills to take on another hotel. He said the West L.A.-Beverly Hills hotel market is one of the nation’s best, second only to Manhattan.

“The L’Ermitage is 39 years old and it’s a nice building,” Reay said. “But with this proposal, you have this new product with a Beverly Hills address. There’s so much demand right now, the city could easily absorb a 124-room hotel. Ninety percent of the cities we deal with love the (transient occupancy taxes). It drives jobs and hotels.”

PANEL DISCUSSION:Boutique Hotel- Start to Finish

Moderator: Bob Sonnenblick, Chairman, Sonnenblick Development Panelists:

May 15, 2014 by Ian Ritter

Robert Sonnenblick, Chairman of Sonnenblick Development, has completed over $1.5B of commercial real estate transactions on the west coast. Among the most notable include: Beaudry Center, LA ($197M), The Ritz-Carlton Hotel, Pasadena ($97M), One Waterfront Plaza, Honolulu, HI ($100M) and the LA World Trade Center ($55M). He was also an original development partner of the $90M Loews Santa Monica Beach Hotel, which sold for $125M.

One commercial real estate sector that GRS Group hasn’t touched on recently in this space is hospitality. Bob Sonnenblick, chairman of Sonnenblick Development LLC, recently filled us in on the current hotel trends, and he had plenty of good news to share. Development is back, core markets are hot and fundamentals are in good shape. Sonnenblick shared what he thinks are the hotel sector’s bright spots.

We hear a lot about multifamily and its boom. What is going on with the hospitality sector right now?

There’s no question that the apartment industry is the darling of the real estate business right now. Every investor, pension fund or builder is actively looking for apartments. But as a result, there has been huge competition in the apartment sector, and it’s taken away most of the profitability of being in that sector. It’s become a very hard and competitive business now.

The exact opposite is the case in the hotel business, where there are very few hotel developers still standing as a result of the previous recession from 2008 to 2012, when most of them all got wiped out. It’s actually a very good time to be a hotel developer right now.

Most importantly, hotel operations are at an all time high this year. Tourism in Los Angeles County just broke a record for the largest dollar volume of tourism ever. The actual business side of our industry is very strong.

What kind of development is happening?

The limited-service hotels, the ones without food and beverage components, like Hilton Garden Inn, Hyatt Place and Courtyard by Marriott, the real select-services are on fire. Those are the ones that are getting built around the country right now. There is very little construction of full-service, high-rise, four-star and five-star hotels.

What is driving this?

It is a very simple concept. The profit margins on the rooms component of a hotel are very high. The profit margins on the food and beverage components are very low. So people are building hotels now with only rooms in them and nothing else. The customer is OK with that. They’ll take a nice room and walk across the street to a restaurant.

There’s clearly an increase in spending that’s happened over the last year. Operations and profitability are up about seven percent this year alone, which is a huge jump. But these select-service hotels are generally equivalent rooms to the full-service hotels, but they’re priced 30 percent lower. The customer loves it.

How is business travel holding up?

Business travel is back up to the levels we had seven years ago. That part is all really good, and next year it will be even higher. In general, the outlook for the hotel industry is a very strong future over the next two or three years with very limited new supply.

Are there any parts of the country doing particularly well?

There are two parts of the country that are very strong, and not surprisingly, it’s the two coasts. The New York-Washington D.C.-Boston market is unbelievably strong. The L.A.-San Francisco combo-market is very strong. The third market that is equally strong is Miami and South Florida. The coastal markets are having phenomenal years. The middle of the country is fairly flat.

Are there any hotel projects you have on tap that you’d like to highlight?